As we head into the end of the trading week, attention will remain on a few familiar topics that have dominated recently, the Federal Reserve, Oil and the aftermath of the ECB response, or lack of, to new lower inflation and growth forecasts.

There may be no US economic data of note on Friday but we will hear from a few Fed policy makers, two of which are voting members on the FOMC this year, throughout the session. Daniel Tarullo, Eric Rosengren and Robert Kaplan will all make an appearance today and offer their views on how the economy is performing and whether a rate hike this year remains the correct course of action given last Friday’s mediocre jobs report and the very disappointing ISM PMI numbers.

A large number of policy makers appear to be coming round to the idea of a rate hike, even those that in the past have typically been quite dovish. Rosengren and Tarullo’s comments will be particularly interesting, given that they are the two voting members of the FOMC and have previously been two of the more dovish policy makers. Both have acknowledged previously that the case for a hike is growing while not indicating when that could come. It will be interesting to see today whether they suggest a hike in September is possible, something that could easily sway the markets given that this is currently all but priced out at 18% implied probability.

Source – CME Group FedWatch Tool

Oil prices were given another boost on Thursday when EIA reported a huge drawdown in inventories, even more so than had been reported a day earlier by API. While the decline in inventories is believed to be due to temporary factors, it was enough to briefly push Brent crude back above $50 and while we’re seeing a small correction today, the upward pressure may remain in the short term. The report will draw attention to today’s oil rig data from Baker Hughes, with the number of rigs having bottomed out in late May but growth has stabilised in recent week at just over 400. Should we see a reduction today, it could provide the catalyst for another push higher in oil prices into the end of the week.

Oil Prices Surge as US Burns Through Crude Supply at Record Rate

In Europe, equity markets are in the red once again today as traders continue to show their disappointment at the ECBs decision not to even announce an extension to its quantitative easing beyond March next year, which was the least the market had expected. There was a belief in the markets that an extension and possible increase in the program would be announced, to offset the expected impact of Brexit on growth and inflation. Given that the ECB is facing difficulties in finding eligible bonds under the current structure and is therefore exploring ways to overcome this, I think markets are overreacting to the decision and expectations were too high. I don’t think anyone expects the program to end in March and it will probably be increased so whether this happens now or over the next six months doesn’t really matter.

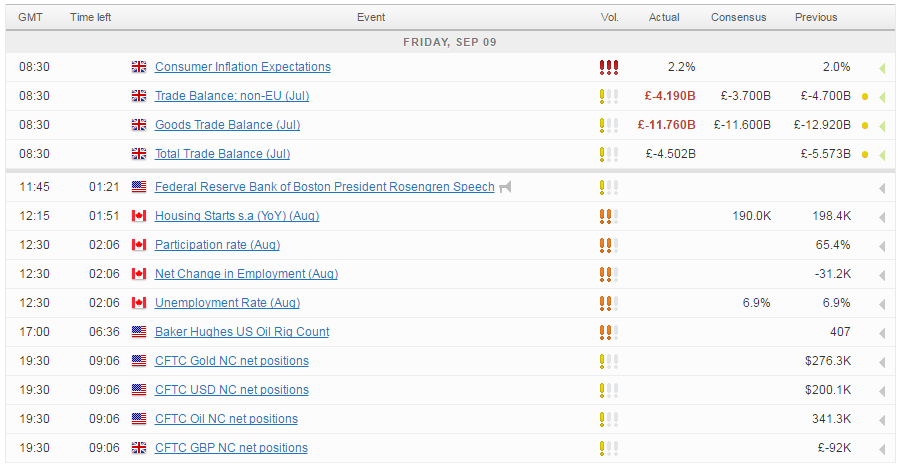

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.