The words “moribund’ and “treading water” have been floated about today to describe the activity in Asia’s financial markets today. My personal favourite was “tepid.” No matter which way you cut it, now that we are in the pre FOMC blackout period ahead of next week’s meeting, (some may say thankfully), Asia is most certainly in wait and see mode.

Predictions of will they won’t they will be bandied around ad-nausium, and I shall not join the chorus. Preferring to wait for the result and the post-meeting price action. For Asia this week this most likely means a return to headline driven, short-term price moves, particularly if the previous New York session has been quiet.

With “tepid” ranges on FX, metals, and stocks, the standout on an otherwise quiet day today has been the Australian 200 Index. After an initial spurt higher on the open this morning it turned south rather forcefully and has ended up a solid -1.75% for the session. Although the large miners had a good day, the index has been weighed down by a sell-off in the major bank stocks and other financial related shares.

The S+P future’s contract’s inability to rally in Asia may also have contributed. One also suspects an underlying nervousness about all things financial ahead of the Fed next week. I get the feeling that despite the odds being at only 22% of a hike, players are increasingly nervous it may just happen. What this shows to me is just how pivotal this event will be for the world’s markets. It is the only show in town.

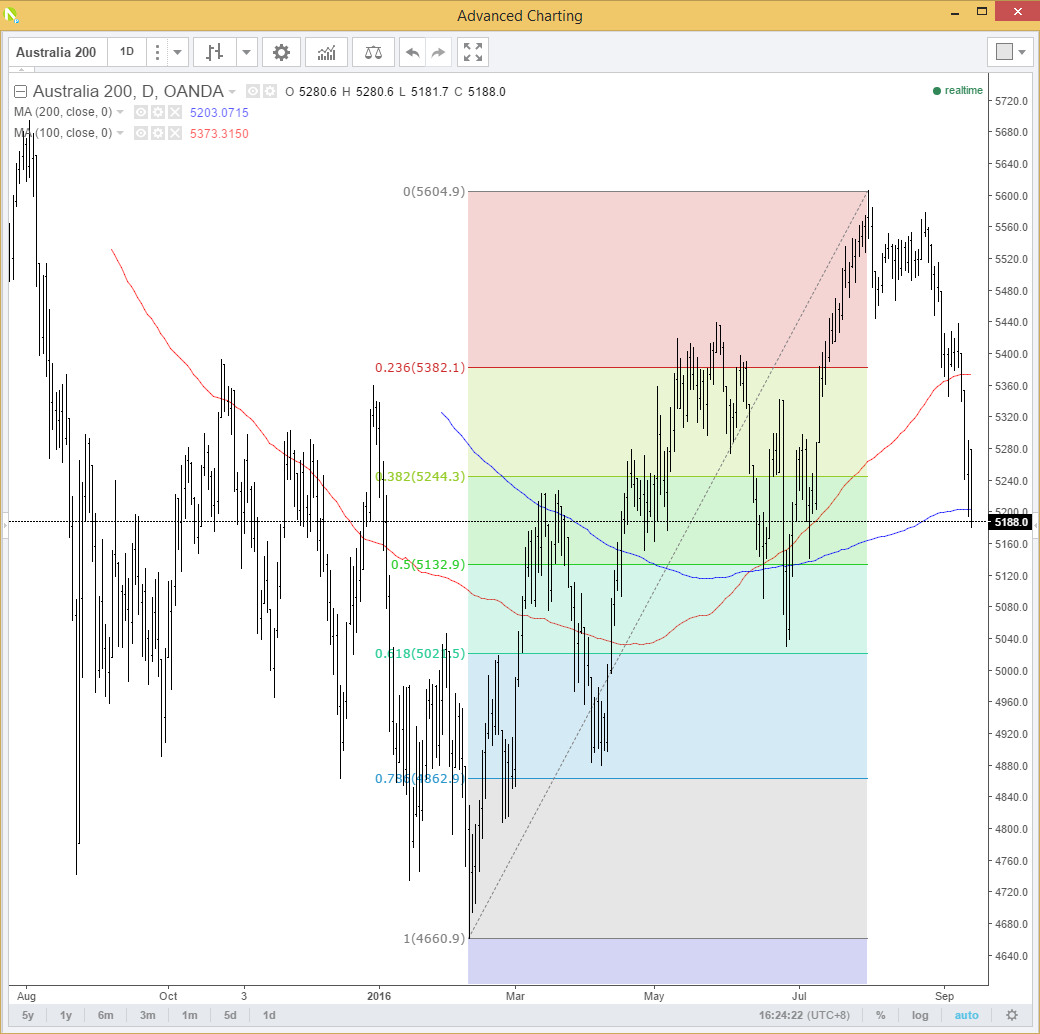

Back to the ASX though, the index is sitting on its 100 days moving average at 5200. The general sell-off in mining stocks and now the financials is really starting to weigh on it.

Technically a close under 5200 is bearish. Resistance is coming in at the 5375 area some previous daily lows and the 200-day moving average.

The next support is 5133 the 50% Fibonacci retracement of the rally from Mid-February until the start of August. As per the chart below. Interestingly it respected the 23.6% re-trace and marched straight through the 38.2% so its performance around 5133 should be carefully monitored.

In summary, despite soothing noises from the RBA today, fears of a Fed hike appear to be riding roughshod over the ASX when combined with the recent commodity sell-off. September is a feast of event risk even post the FOMC decision. We still have the Bank of Japan and OPEC to name just two, and I note “The Donald” seems to be picking up in the polls. However headlines aside, for Asia this week the Federal Reserve will be the only game in town.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.