US futures are pointing at a slightly higher open on Wall Street on Tuesday as we look ahead to more Fed speeches, although focus in the European session has so far been on the moves in sterling and the ongoing Deutsche Bank saga.

The pound is on the slide again this morning despite the construction PMI for September indicating that firms are more optimistic on the residential sector than they had been following the referendum. The move back into growth territory for the construction sector was another boost for the UK in the latest sign that the economy is dealing with the early aftermath of Brexit better than was anticipated.

UK Data, Brexit and Deutsche Bank Remain in Focus

While I’m not confident this will continue once article 50 is triggered and negotiations begin, it is encouraging to see areas of the economy carrying on as normal despite the uncertainty that now hangs over many industries. Still, the pound has posted fresh 31-year lows this morning, with comments over the weekend from Prime Minister Theresa May and yesterday from Chancellor Philip Hammond weighing on the currency. Hammond’s warnings of economic difficulty and fiscal uncertainty have added to the sterling blues over the last 24 hours and could have triggered a new wave of weakness for the currency. With the post-Brexit lows now having been broken, we could see the pound trading back towards 1.25 against the dollar in the not too distant future, and at more than five year lows against the euro.

The rest of the session is looking a little lighter from a data perspective but we will hear from two Fed officials, Jeffrey Lacker and Charles Evans. While these are not voting members of the FOMC this year, it will be interesting to get their insight on the recent economic data and whether a rate hike this year remains on the cards. For once, the market appears to be buying what the Fed has been selling, with a December hike now 62% priced in.

USD/CAD Canadian Dollar Rises as Oil Rallies Higher

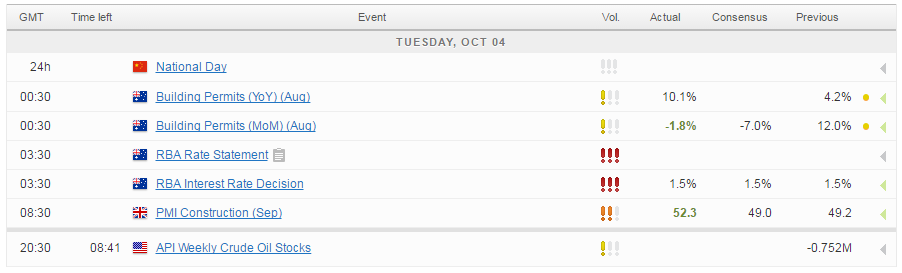

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.