Thursday is shaping up to be one of the quieter sessions of the week as traders digest the events of the first few days and positions themselves ahead of tomorrow’s US jobs report.

It’s been a very lively start to the week, with Gold having plummeted through the $1,300 support on Tuesday before stabilising temporarily around $1,265, while the pound has hit a new 31-year low and looks on course to extend losses in the coming days and weeks. In both these cases, what we’ve seen so far looks like a dead cat bounce which would suggest further losses are on the horizon. Both are trading marginally in the red again today, but look to be holding off until after tomorrow’s jobs report before making their next moves.

The US dollar has once again been the stand out performer among the majors today, edging higher again as traders continue to price in a rate hike in December following another string of hawkish comments from Federal Reserve policy makers. It will be interesting to see whether this can be sustained into the end of the week as a poor NFP number tomorrow will likely once again case doubt on whether the Fed will pursue further tightening this year. The ADP number on Wednesday – seen as a rough estimate of the NFP – blew no one away but wasn’t quite bad enough to hugely affect the market implied probability of a hike in December. We currently stand at 60% which is very high given that the market has doubted the Fed – as it turns out, correctly – throughout the course of 2016, a year in which the Fed had intended to hike four times but has yet to do so once.

Source – CME Group FedWatch Tool

Oil is pushing for another day of gains, having been on a great run since the start of last week on the back of the OPEC output deal and numerous inventory drawdowns. Even these gains now appear to be running on empty having rallied to the highest level in almost four months on what is effectively a loose deal that may never be carried out as intended and some drawdowns in what is still an oversupplied market.

EUR/USD – Euro Edges Lower, Markets Eye Key US Job Numbers

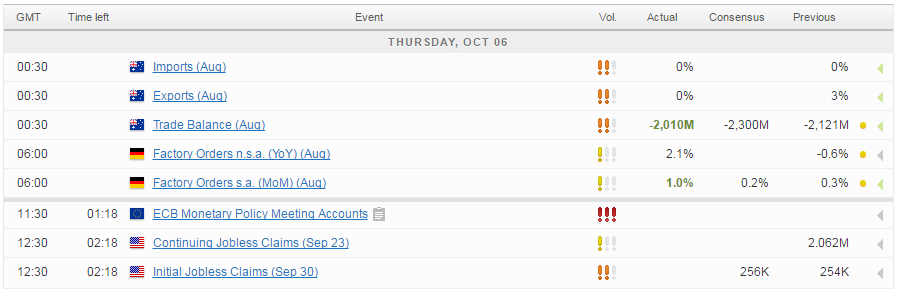

As for today, focus will be broadly on tomorrow’s jobs data from the US in the absence of many scheduled economic events today. Of the little data we will get today, the one that stands out is initial jobless claims but with the number having rarely deviated from current levels for most of this year, I’m not expecting much from the release.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.