Will NFP Cast Doubt on December Rate Hike?

The US economy has been debated all year by policy makers, market commentators and investors everywhere as people have tried to anticipate the path of monetary policy and what impact that will have on the markets.

Clearly the debate has been far from straight forward with the Federal Reserve at the start of the year forecasting four rate hikes and some in the markets, zero. As the year has progressed, it has become clear that the markets had a much better idea of how things were going to materialise than central bank policy makers did.

Still, as we enter the final few months and with only two meetings remaining, the Fed seems determined to raise interest rates once more, with the most likely time for this being December. This is due to the Presidential election being a week after the meeting in November and that meeting not being accompanied by a press conference, at which Chair Janet Yellen would be expected to explain the decision to hike.

GBP/USD – Pound Slide Resumes on ‘Hard Brexit’ Jitters

With all of this in mind, US economic data is going to continue to be heavily scrutinised in the coming months for any signs that the Fed is going to be left in a position in which it can’t feasibly justifying raising rates this year. With the data being very mixed throughout the year, this is far from a straight forward decision.

As it stands, the markets are finally in alignment with the Fed in expecting a rate hike in December (64% priced in according to Fed Funds futures) but this could rapidly change should some of the more important pieces of data disappoint.

Source – CME Group FedWatch Tool

Arguably, no piece of data is as influential as the US jobs report, offering insight into the labour market strength – one half of the Fed’s dual mandate – and wages which will likely be a key driver of future inflation – the other.

The non-farm payrolls (NFP) are usually the most heavily scrutinised by the markets and tend to be the first number to drive market moves in the immediate aftermath of the release. Wages will generally then play a part in the moves that follow.

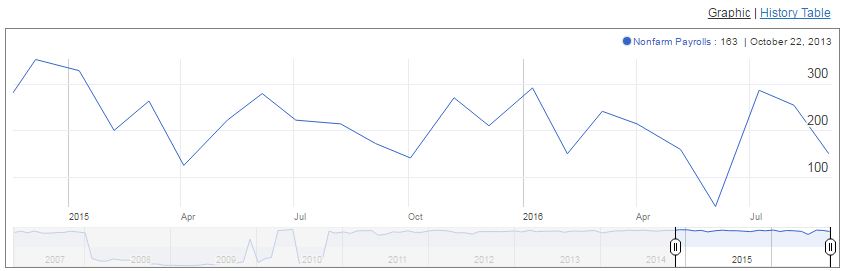

This year the average number of jobs created has fallen to 181,500 (not including any future revisions), down from 228,666 in 2015 but this is seen as more than enough by the Fed to warrant a continuing tightening of monetary policy. The numbers this year have also varied greatly from as low as 24,000 in May to as high as 275,000 in July so there is clearly a wide range for this number each month.

Source – Economic Calendar

Despite the average being high enough for the Fed given the low levels of unemployment (4.9%), should we see a couple of poor readings ahead of the December meeting, it may become concerned that the numbers are the start of a worrying trend and that the economy is slowing down.

With that in mind, traders will be looking at these numbers closely and any disappointing release, say around or below 100,000 could spark quite a reaction in the markets with traders once again pricing out December which could be bearish (bad) for the dollar, negative for Treasury yields (positive for prices) and bullish (good) for Gold, given the correlation.

USD/CAD – Loonie Edges Lower, Canadian Building Permits Next

Anything in line or above could be seen as increasing the possibility of a rate hike in December and the markets could react accordingly.

One thing is often the case around the release of the NFP number, the markets can become quite volatile and remain so for a while afterwards so traders should be prepared for such an outcome.

For more on what you can expect to see on the charts, including technical analysis on EURUSD, GBPUSD, USDJPY, USDCAD and Gold, check out our NFP Preview video.

It’s also worth noting that we have four Fed officials speaking after the release of the data (vice Chair Stanley Fischer, Loretta Mester, Esther George and Lael Brainard) so markets could remain quite volatile into the end of the week.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.