It’s been a crazy start to trading on Friday, with the flash crash in the pound overnight coming ahead of what was already expected to be a volatile session as we get the September payrolls data and speeches from four Fed officials.

The cause of the crash in the pound is still unknown, with a number of factors probably at play including a fat finger trade, very low liquidity, a large number of stops being triggered and algorithms exacerbating the move. While the pound has recovered a large majority of its losses, it continues to trade well below yesterday’s levels which just goes to show how pessimistic people are about the UK economy in a week in which people have come to realise that a hard Brexit, or something that resembles it, is not just a possibility but a probability. It will be very interesting to see how the pound trades into the end of the week because having already shed almost 5% against the dollar this week, the move is already looking a little overdone.

EUR/USD – Euro Edges Lower, US Nonfarm Payrolls Loom

Once again the biggest beneficiary of the pound slide has been the FTSE with the inverse relationship between the two having strengthened again recently. With a large portion of FTSE 100 company profits coming from outside the UK, any depreciation in the pound is ultimately good for earnings and therefore acts as a trigger for FTSE gains.

As we head into the US session, attention is likely to shift to the release of the September jobs report and the appearances of four Fed officials that follows. While the market has not got on board with the Fed’s views on rate hikes throughout the year, they do appear to have bought into the desire for a rate hike in December, for now. At 64% priced in, the market is now vulnerable to disappointing data that could once again jolt the markets into doubting whether the central bank will follow through on its intention to raise interest rates.

Source – CME Group FedWatch Tool

It will be very interesting to see just how the market responds if we get an NPF number around 100,000 or below today. We could well see the dollar take a nose dive having thus far had a very strong week.

APAC FX – Sterling Flash-Crash Starts Non-Farm friday

What makes today’s report even more interesting is that it will be followed by speeches from four Fed officials including vice Chair Stanley Fischer. Their response to the report could have a big impact on whether the markets are still buying into a rate hike this year, or whether expectations once again get pushed back to 2017. I think we can continue to expect plenty of volatility throughout the session on Friday.

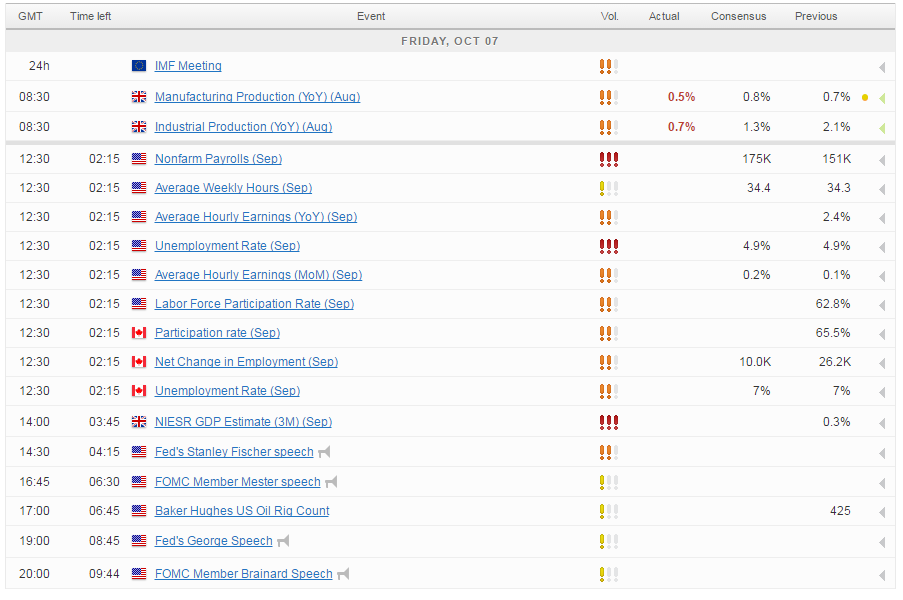

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.