Focus will very much be on the US as we see out the end of the week. Recent moves in the pound and oil have overshadowed the US a little bit but today, it should take centre stage once again.

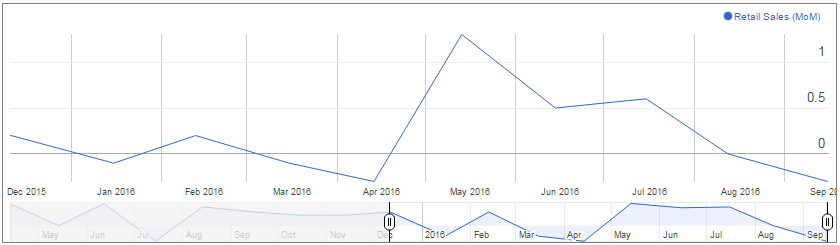

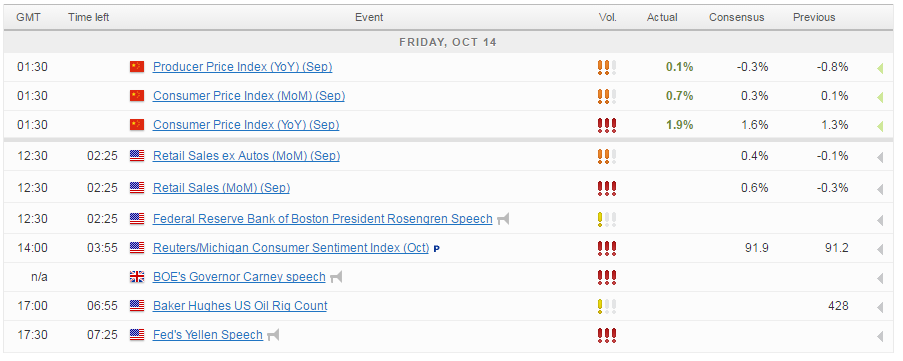

The US retail sales number stands out for me as being the key release today. We saw a strong rebound in spending in the second quarter which set us up nicely for a good summer but US consumers just didn’t deliver. A couple of disappointing reports in July and August once again cast doubts over the strength of the US economy, something markets have so far been willing to overlook, with investors still pricing in a December rate hike. Should the US make it a hatrick of poor spending numbers, then investors may once again find themselves questioning December.

Source – Economic Calendar

USD/JPY – Dollar Pushes Yen Above 104, Key US Data Looms

While fluctuations in retail spending has been a cause for concern, consumer confidence has remained near the highest levels since before the financial crisis. With that in mind, another strong number today may do little to build confidence for the months ahead, yet a weaker reading, especially if combined with a poor retail sales figure for September, could worry investors and force them again to reassess the December rate hike chances.

Finally today we’ll hear from Federal Reserve Chair Janet Yellen, whose views are going to be crucial come the December meeting. Last December, Yellen managed to get unanimous support for a rate hike, the first in almost a decade and one that some members may not have been convinced by. Given this show of leadership almost a year ago and the fact that three of the ten voting members dissented at the last meeting, I think it’s clear that Yellen holds the key to when rates will rise. Her views will therefore be scrutinized for any clues on the timing of the hike and given that markets have strongly priced one in, any hint of doubt with regard to December could be seen as a sign of weakness by the markets and could result in dollar weakness and falling treasury yields. We’ll also hear from one of last month’s dissenters Eric Rosengren today although his comments, unless dovish, may be overlooked as he is already expected to push for a hike at the upcoming meetings.

USD/CAD Canadian Dollar Higher After Chinese Data Hurts USD Rally

We’ll also get a number of earnings releases, with particular focus on the banks as Citigroup, JP Morgan and Wells Fargo report. With all this in mind, markets are likely to be quite volatile on Friday. It will be interesting to see if Europe and US indices can hold onto early gains with both having had a tough week and looking on the verge of entering a broader downturn as some major technical support levels were strongly tested.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.