A negative start to European trade following a similar move in Asia overnight is weighing on US futures ahead of the open on Wednesday, with declines in oil weighing and earnings remaining in focus.

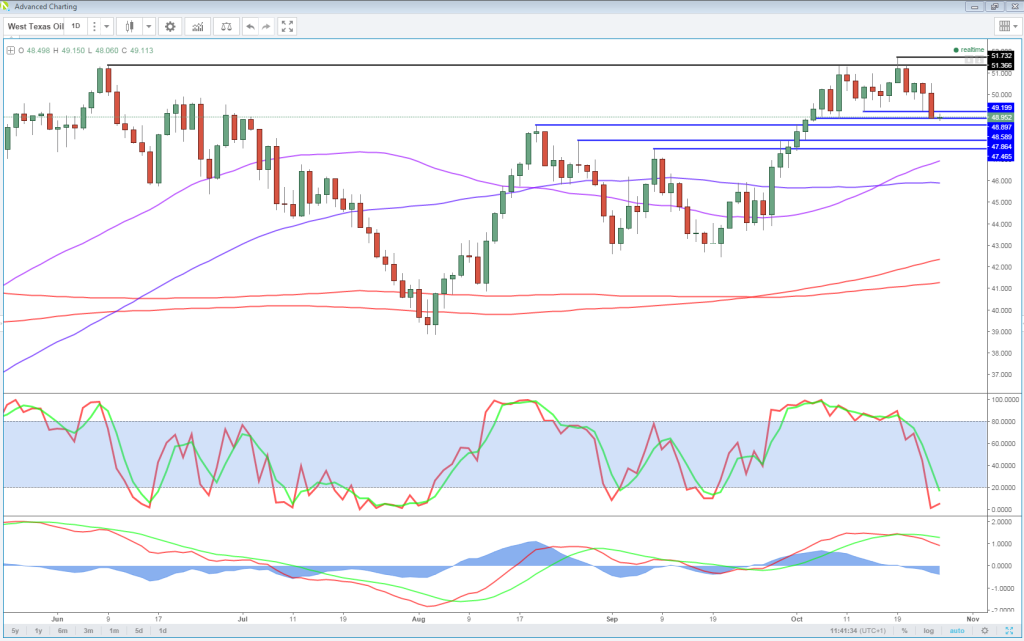

Oil is off more than 1% having gapped lower overnight after API reported a larger build in inventories. This comes as the market had already turned more bearish, leaving it more susceptible to downside moves, after Iraq threw a spanner in the works of the OPEC deal suggesting it should not be involved. The gap lower in WTI took it through $49.70 support and may have opened up a move back towards $47.20, potentially triggered today by EIA confirming or adding to API’s reported build in crude inventories.

OANDA fxTrade Advanced Charting Platform

Big Dollar Dips Amid Lack of Trading Clues

Equity indices are lower across the board in Europe this morning, with the decline in commodities taking its toll. Even without the decline in commodity prices, these indices continue to look toppy at the moment, particularly in the US where we’re constantly failing to record new higher highs. While we may be well supported for now, this is not a set up that is indicative of a market that’s about to tear higher. Especially not against the fundamental backdrop of mediocre earnings and a Federal Reserve rate hike.

Once again today we have just under 10 of the S&P 500 companies reporting on the third quarter, while we’ll also get a response to those companies that reporting late on Tuesday, including Apple which is expected to come under pressure following a rare annual revenue decline. While the decline itself may be rare, it was not unexpected with its quarterly revenue declining for a third consecutive quarter.

USD/JPY – Yen Unchanged as Japanese Inflation Edges Upwards

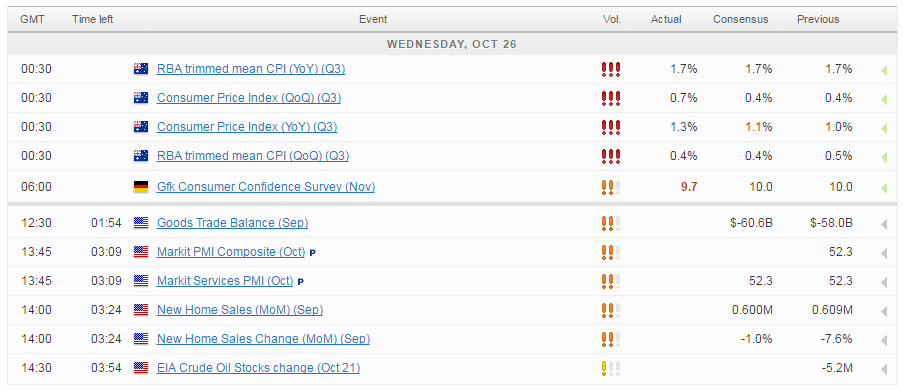

We’ll also get some economic data during the US session including the services and composite PMIs for October and new home sales for September. The Fed has now entered is blackout period ahead of next week’s meeting so it will now be quiet on that front.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.