US futures are treading water ahead of the open on Thursday as traders await another batch of third quarter earnings reports and some important economic data.

Earnings season has seen some mixed results so far which is failing to get investors excited about the stock market. Despite rallying to new highs earlier in the summer, the stock market has shown itself to be a little vulnerable to downside risks over the last couple of months and the combination of mixed earnings and a Fed rate hike in December could prove to be a nasty cocktail that doesn’t sit well with investors.

USD/CAD – Canadian Dollar Unchanged, Markets Eye US Durables and Jobless Claims

The charts just aren’t looking great for the S&P and Dow. They may have survived recent dips, with the S&P finding buyers around 2,105-2,115 and the Dow around 18,000 but what is concerning is that they repeatedly fail to even reach the previous highs before they head south again, let alone challenge the levels from earlier this summer.

OANDA fxTrade Advanced Charting Platform

If this trend was going to change I think we needed a strong earnings season and/or the Fed to change course, neither of which now looks likely. Not with markets now pricing in almost an 80% chance of a hike in December.

Source – CME Group FedWatch Tool

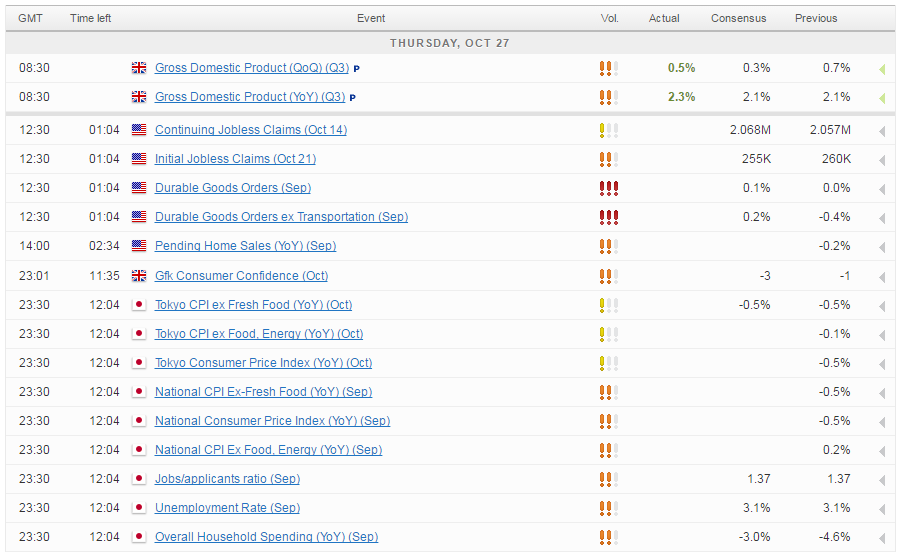

The economic data will be another focal point for investors today, with durable goods orders, jobless claims and pending home sales data being released throughout the session. Durable goods orders is a particularly important economic indicator for the US economy as it offers insight into not only the current environment, but also expectations of the economic outlook and companies investment plans. The monthly numbers can be quite volatile though, as we’ve seen repeatedly this year.

Scandi Central Banks Don’t Disappoint, U.K GDP Surprises

Oil markets will likely remain a key focus today given the moves we’ve seen over the last week and yesterday’s surprising inventory drawdown, as reported by EIA. API reported on Tuesday that inventories rose by 4.8 million last week which piled further downside pressure on oil, which was already heading south on doubts over the OPEC output deal. The EIA release actually showed another drawdown in stocks which has provided a small boost to oil, although not that big considering the declines we’ve seen recently, possibly suggesting momentum remains to the downside.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.