It could be another tough session in the US on Friday as next week’s Presidential election continues to hang over the markets, although today’s jobs report may offer a welcome distraction.

The November jobs report would typically be a massive deal for the markets, especially coming a month before the Fed is expected to raise interest rates but the circus that is the US election has completely overshadowed it on those occasion. The prospect of a Trump presidency, it seems, is a much greater risk for investors than a measly 0.25% rate hike next month.

NFP Just a Sideshow, Focus Remains on U.S Election

It would appear that risk aversion is going to carry markets into the weekend, with investors potentially unsure of what the next couple of days will bring. Last Friday provided quite a shock for markets, another significant blow for Clinton could all but hand the Presidency to Trump. Investors are not willing to take that risk, it seems.

The jobs report may not be the main event as far as traders are concerned but it is still a major release. There are two jobs reports remaining ahead of the December meeting and the Fed claimed in its recent statement that while the case for a hike has continued to strengthen, it still wants further evidence of continued progress. While this may well have been code for “we don’t want to raise rates just before an election” we have to assume that disappointing numbers over the next six weeks will throw a rather sizeable spanner in the works. Even if the greatest obstacle would most likely be a Trump victory and the economic uncertainty and market volatility that could create.

EUR/USD – Euro in Holding Pattern Ahead of US Nonfarm Payrolls

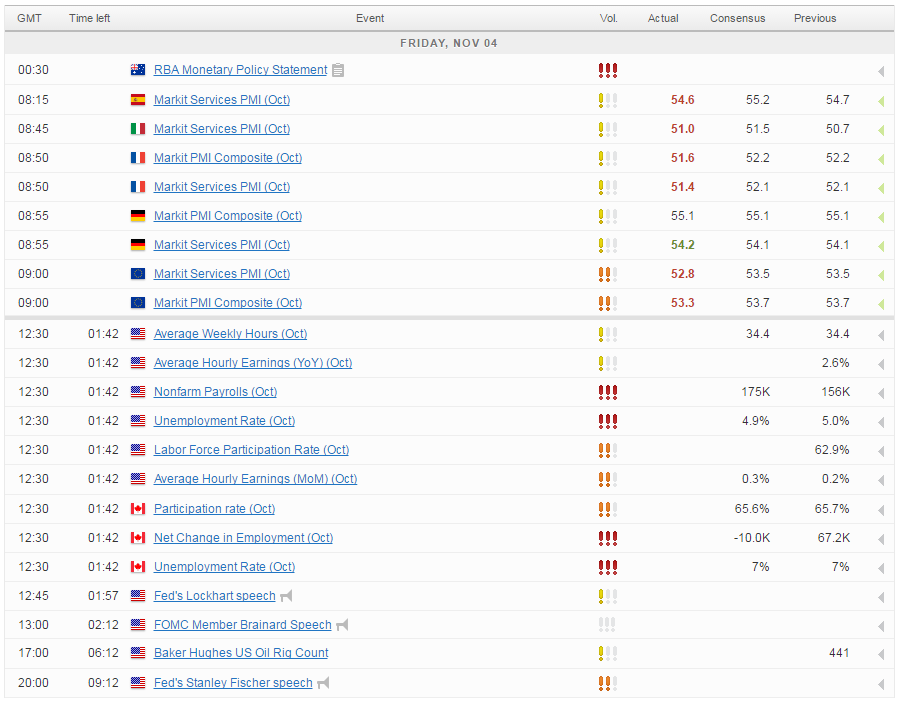

With unemployment at 5% and expected to fall and job creation still very strong and expected to post another 175,000 gain last month, we may have to look at some of the other numbers to give the Fed the comfort it apparently still requires. Of course, the unemployment and non-farm payrolls numbers will likely write the headlines and spark the early reaction in the markets but I think the Fed may be more concerned with wage growth and participation. Wages have been growing at 2.6% recently and I think the Fed will want to see signs that this will continue to improve. The participation rate has also been improving but from very low levels. People returning to the labour force is the sign of a healthy labour market and confidence in it. It will also mean the US is hoovering up some more of the remaining slack in the market.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.