European equity markets are positioned to open more than half a percentage point higher on Monday, boosted by the news that the FBI has not changed its conclusion on the Hillary Clinton email investigation after announcing a little over a week ago that it had been reopened.

The timing of FBI Director James Comey’s disclosure has once again dealt a serious blow to Donald Trump’s chances of securing the White House, something the markets have responded very positively to. Risk appetite has returned at the start of the week following an awful run which saw the S&P 500 go on a nine session losing streak, the longest in nearly 36 years.

OANDA Trading Desk : Political Risk

Gold last week assumed its role as the Trump hedge, rallying back towards $1,300 and on a few occasions threatened to break beyond this new found resistance. Having failed to break through here, Gold now finds itself down more than 1% on the day and could come under further pressure as the day progresses and traders respond to the latest twist in the what has been one of the more bizarre Presidential campaigns.

OANDA fxTrade Advanced Charting Platform

The only question now is whether the FBIs latest conclusion has come too little too late for Clinton and if the initial disclosure has done irreparable damage to her campaign. For a large number of voters, the fact that the FBI is yet to find anything to determine her guilt will not give them comfort and the fact that she has been embroiled in this investigation right up to polling day will create a huge trust issue.

There very often is not smoke without fire and I think this may play on many voters’ minds as they go to cast their vote. This may be why we’re seeing sentiment improving this morning but investors are not yet getting carried away. The investigation obliterated Clinton’s poll lead last week and traders may be awaiting some indication that Clinton has retaken a convincing lead.

Week Ahead US Presidential Election to Dominate Markets

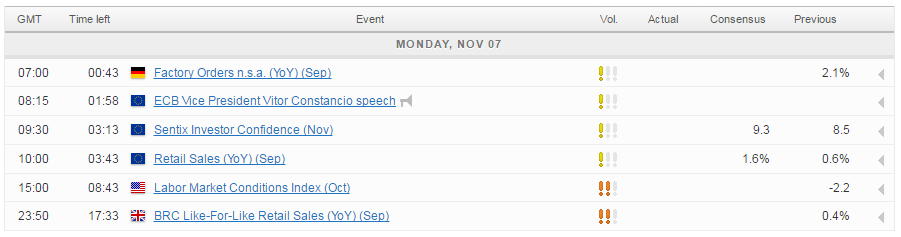

Heading into tomorrow’s vote, there isn’t much else on offer in terms of major economic events or earnings which will ensure focus remains primarily on the election. Retail sales and investor confidence numbers from the eurozone are the only releases that stand out today but I expect they may pass with little attention given the much more important vote tomorrow.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.