We may have already seen the worst of the moves in the markets following Donald Trump’s surprise victory in the Presidential election this morning but US futures continue to point sharply lower ahead of the open on Wednesday, reflecting the strong risk aversion that still exists in the aftermath of the vote.

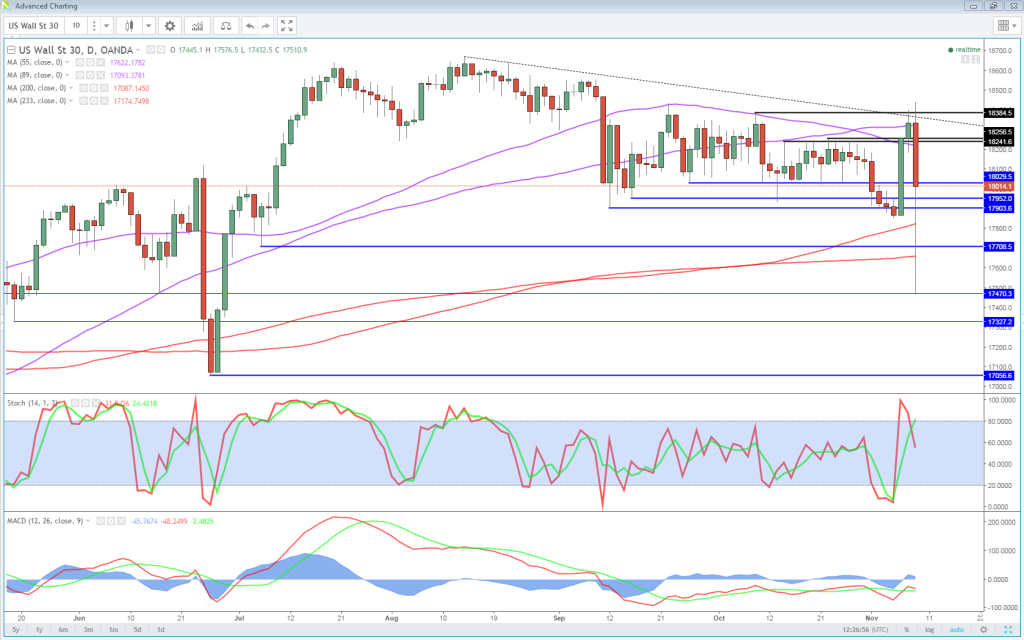

OANDA fxTrade Advanced Charting Platform

Markets have pared their earlier moves following the substantial knee jerk reaction to Trump securing an unlikely victory over rival Hillary Clinton. While the result was unexpected, the reaction in the markets stems once again from them being poorly positioned heading into the vote, overconfident that Clinton would ease to victory despite only having a narrow lead in the polls and being embroiled in an FBI investigation days before.

USD/JPY – Yen Surges on Trump Shocker as Markets in Turmoil

The greatest oversight was the significance of the anti-establishment feeling in the US, similar to that which prompted the UK to quit the EU in June. It’s clear no lessons were learned from the Brexit vote on June 23.

Risk aversion is likely to remain strong in the US session today, with futures edging lower again over the last few hours having halved their initial plunge. Safe haven Gold continues to trade above $1,300 and could see further upside if risk aversion intensifies once again. The question now is how long will all of this last.

Markets Stop the Bleed For Now

Markets generally rebounded quite well after Brexit but this was aided by the rapid response of the central bank and the UK quickly getting its political house in order, providing reassurance for investors. While Trump slightly soothed some concerns in his victory speech, uncertainty remains over what kind of a US he plans to lead and the Federal Reserve is unlikely to provide the same assistance that the Bank of England did at this stage. It will be very interesting to see whether they still intend to raise interest rates next month, as they have alluded to recently.

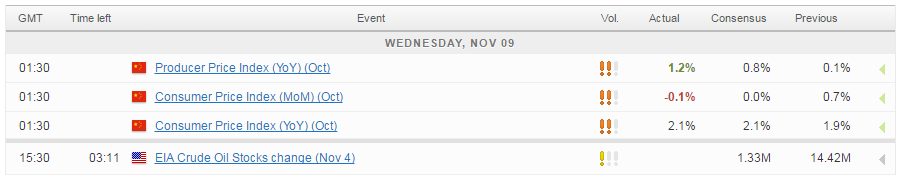

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.