European equity markets are expected to open higher on Monday, buoyed by the news over the weekend that OPEC and non-OPEC producers have agreed to cut output by almost 1.8 million barrels per day.

The agreement, which builds on the 1.2 million barrel per day cut agreed by OPEC earlier this month, saw Brent and WTI crude hit their highest level since July last year and they continue to trade almost 5% higher ahead of the European open.

Oil Jumps 5% in Early Asia Trade

With the deal now in place, the only questions that remain is whether participants will comply with the cuts and whether non-participants, such as the US, will increase output as prices rise. The amount by which both of these happen will determine how successful the deal has been.

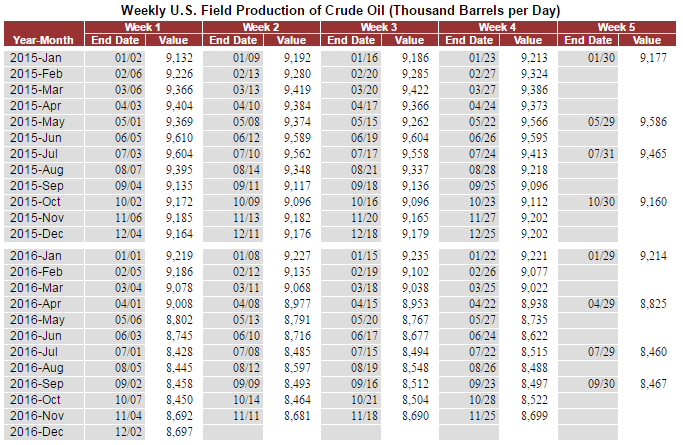

While this deal has already come as a surprise to many doubters, there is still a number of hurdles to overcome over the next six months that could see oil rapidly reverse these moves. Even if we get full compliance in the deal, which is by no means a guarantee, US oil rigs are coming back online at a very fast rate – up to 498 last week from the lows of 316 in May – and output has been rising over the last month or two.

For a look at all of today’s economic events, check out our economic calendar.

Source – EIA US Crude Oil Production

This deal and the higher prices that comes with it will only accelerate the process and could offset a chunk of the cuts agreed by OPEC, possibly threatening to derail the deal itself.

The other main focus for traders today will likely be the Federal Reserve meeting which will take place on Tuesday and Wednesday, with the announcement and press conference coming on Wednesday evening. While a rate hike is almost entirely priced in, the Fed’s expectations for the year ahead will be key, with markets currently remaining quite cautious on further increases next year.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.