US traders are eyeing more record highs as we near the open on Wall Street on Tuesday, with all three major indices currently seen opening around a third of a percentage point higher.

The Trump rally has been relentless in recent weeks, aided more recently by the rally in oil which is helping to support the energy sector. Brent and WTI are trading just shy of 1% higher again today after the International Energy Agency raised its forecast for oil demand this year and next in its latest report, providing further bullish momentum at a time when OPEC and non-OPEC members have come to a surprise agreement to cut production from January. Another push higher could see Brent target $60 for the first time since July last year, with WTI possibly hitting $57.

OANDA fxTrade Advanced Charting Platform

USD/CAD – Canadian Dollar Unchanged, Fed Rate Hike Looms

The coordinated agreement on a production cut between OPEC and non-OPEC members could throw another spanner in the works for the Fed which is already likely to have a tough time providing accurate projections for the coming year, given Donald Trump’s ambitious spending plans. Assuming the cuts are implemented as planned which is far from certain, the moves in oil prices could provide further inflationary pressures for the Fed at a time when inflation is already expected to rise and any fiscal stimulus will only add to this.

Markets Look For Conviction From Fed

Against this backdrop, the Fed may be forced to raise interest rates at a faster pace that it had planned and the markets have currently priced in. With this in mind, and given that a rate hike tomorrow is almost entirely priced in, the Fed’s projections and dot plot combined with Chair Yellen’s comments in the press conference could be crucial in determining whether the santa rally makes it to the new year. Investors haven’t been easily spooked recently but the prospect of three or four rate hikes next year may be enough to do it.

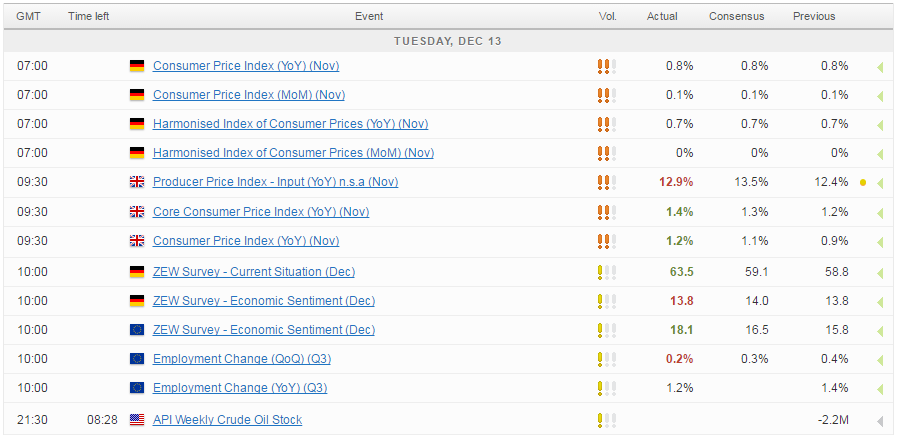

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.