US futures are trading relatively flat ahead of the open on Wednesday, with traders opting for the cautious approach ahead of the final Federal Reserve decision of the year and a selection of economic releases.

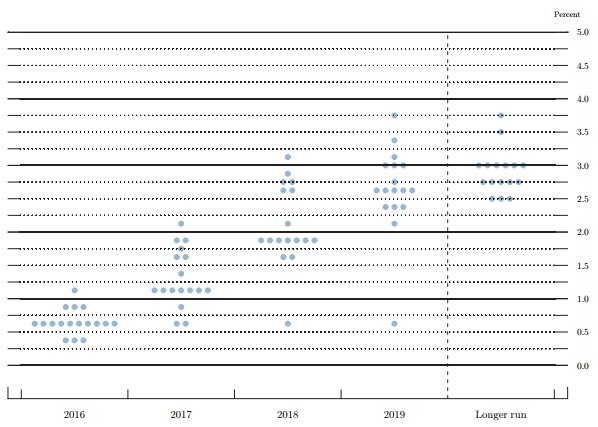

Traders have been very bullish in the lead up to the meeting which is expected to produce the first and only rate hike of 2016, despite the Fed last year forecasting four. It would seem the promise of government spending in the coming years has made investors less anxious about the prospect of interest rate increases, although as always it’s a matter of pace more so than the actual act of tightening which is what makes the projections, dot plot and press conference so important today.

Source – Dot Plot from September Federal Reserve Economic Projections

USD/JPY – Yen Quiet as Tankan Indices Meet Expectations

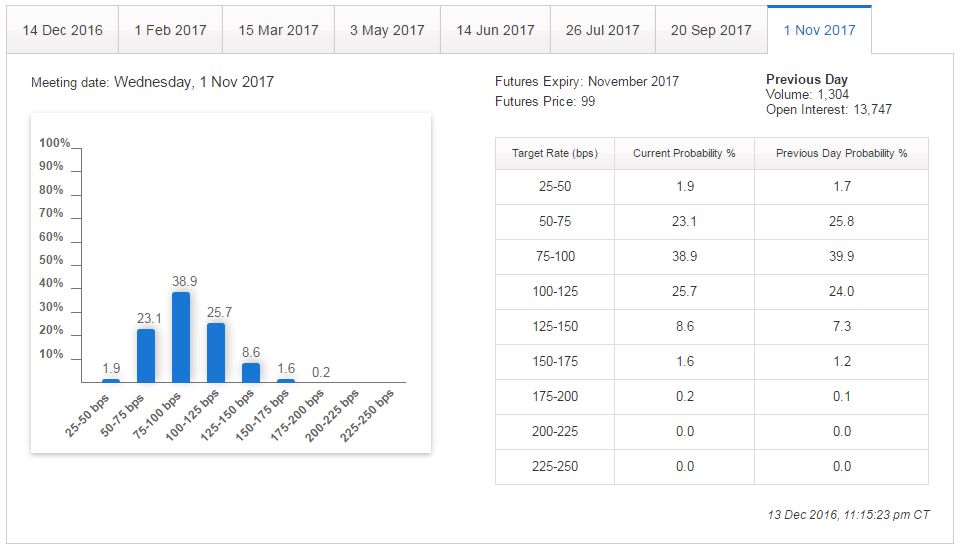

Given the already tightening labour market and improving wage and inflation environment, the prospect of fiscal stimulus and the rise in oil prices, it will be interesting to see just how hawkish the Fed’s projections will be. I think Chair Janet Yellen will be keen to avoid spooking the market, especially at this time of year, but the forecasts may come as a surprise to investors, with markets currently pricing in only one rate hike by November.

Source – CME Group FedWatch Tool

It is possible that this relentless rally that has seen all three major US indices hit record highs may have left them vulnerable to a Fed wake-up call that could bring the santa rally to a premature conclusion. That may well depend on just how Yellen handles the press conference and manages expectations. Draghi did a good job last week when the ECB cut its asset purchases, a move that apparently is absolutely not tapering. Today we’ll find out if Yellen is up to the task, or if markets will just take the same approach as last year and dismiss the Fed’s projections altogether which as it turns out worked quite well.

Fed Lift Off Starts Today – What Else Should We Expect?

Prior to the Fed decision we’ll get a selection of economic data from the US including the November retail sales report which is among the most important releases each month. The consumer is extremely important to the US economy and has been somewhat of a latecomer to the recovery. The Fed will want to see further evidence that the consumer is a permanent part of it in order to have confidence that the economy can go from strength to strength. We’ll also get capacity utilization, industrial production and business inventories data from the US as well as crude inventory data from EIA.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.