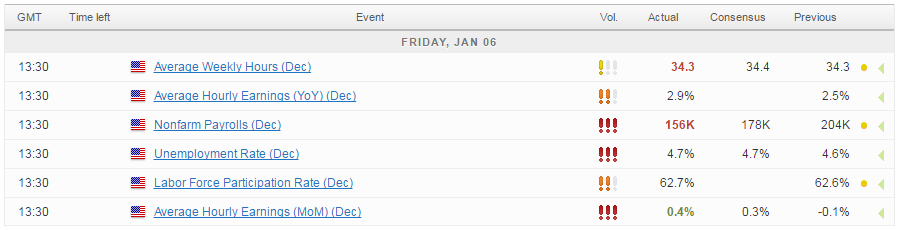

December’s report on the US labour market in December was broadly in line with expectations, with the shortfall in job creation being offset by a similar upward revision to the November number. Unemployment rose to 4.7% as expected while participation ticked higher to 62.7% from a downwardly revised 62.6%, but remained worryingly and frustratingly close to its post-financial crisis low.

Markets Have Bigger Troubles Than NFP

Low participation may be a lingering thorn in the side for the Fed but one big positive to come from the report was an increase in earnings. Average hourly earnings were up 2.9% in December from 2.5% the month before which will offer encouragement to the central bank, after having been frustrated throughout the recovery at the lack of progress here despite unemployment having fallen considerably. Should earnings continue on the current trajectory then inflationary pressures should continue to build and enable the Fed to raise interest rates three times this year as planned, even in the absence of a large fiscal stimulus package from a Trump government.

With wages rising and unemployment low though, any stimulus may force the Fed to raise interest rates even more than the three times it has indicated which would lift the dollar further and see Treasury yields continue the move higher. The jobs data has seen Gold come off its highs having capitalised on dollar weakness in recent days.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.