A lively start to the year looks likely to continue into week two, with the pound coming under particular pressure this morning as the prospect of a harder Brexit continues to sink in.

While investors and businesses would like to see the UK government prioritise single market access and continued strong trade ties with the EU during the negotiations, it’s clear that control over immigration and laws will come first. The EU has made it perfectly clear over the last year that access to the single market and free movement go hand in hand so it would seem we’re heading for a harder Brexit, rather than a business friendly soft option.

Sterling Battered on PM May’s Comments

While the pound is once again suffering at the prospect of this, as often happens when the reality starts leaning more towards hard Brexit, it’s worth remembering that the outcome is not binary and the reality will fall somewhere in the middle. While most people are aware of this, markets can often be more irrational, particularly in the early stages. I think we’re reaching a point where the government’s position is becoming quite clear and while the pound may weaken further as the data deteriorates, it may become less sensitive to Brexit rhetoric going forward.

OANDA fxTrade Advanced Charting Platform

On the data front it’s been a little quieter today and is likely to continue to be during the US session. The US dollar index has continued to strengthen on Monday, up around one tenth of one percent, with Friday’s jobs data likely being the main driver behind these moves.

USD/JPY – Yen Subdued in Light Holiday Trade

Improved earnings growth has long been seen as the missing component when it comes to the Fed hitting its inflation target and the signs are there that the ever tightening labour market is finally baring fruit here. This makes three rates hikes this year all the more likely and could even lead to more, especially if Donald Trump follows through on his promise of stimulus.

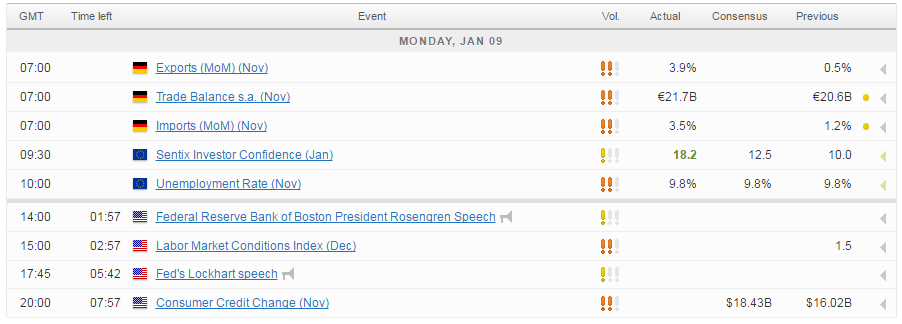

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.