It’s been a slow start to trading on Monday, with a lack of major news flow or data providing few catalysts, but unlike last week that is unlikely to continue with numerous events scheduled that could shake things up.

The feeling at the start of the week is predominantly of relief. Donald Trump met with Shinzo Abe over the weekend which, given his tone towards Japan during his election campaign, could have been a tasty affair but as we saw following a phone call with Xi Jinping on Friday, the meeting appeared to go very smoothly. Of course we know very little about what was said behind the scenes but there is a sense of relief that the joint statement focused on “bilateral cooperation”, which appeared to be a welcome step down from Trump’s previous stance.

Dollar Finds Some Mojo, But Not Much

This sense of relief is helping drive equity markets higher in Europe and US futures suggest we’ll see similar moves on Wall Street when the bell gets the week underway. The noises coming from the White House over the last week have certainly been more market friendly, with Trump also signalling that sweeping tax cuts that were promised during the campaign will be announced in the next few weeks. Other policies will continue to leave a cloud of uncertainty over markets for now but with all three major indices at record highs, it’s clear that investors are pleased with how things are progressing, so far.

APAC: USD Stronger On 27 Holes Of Golf

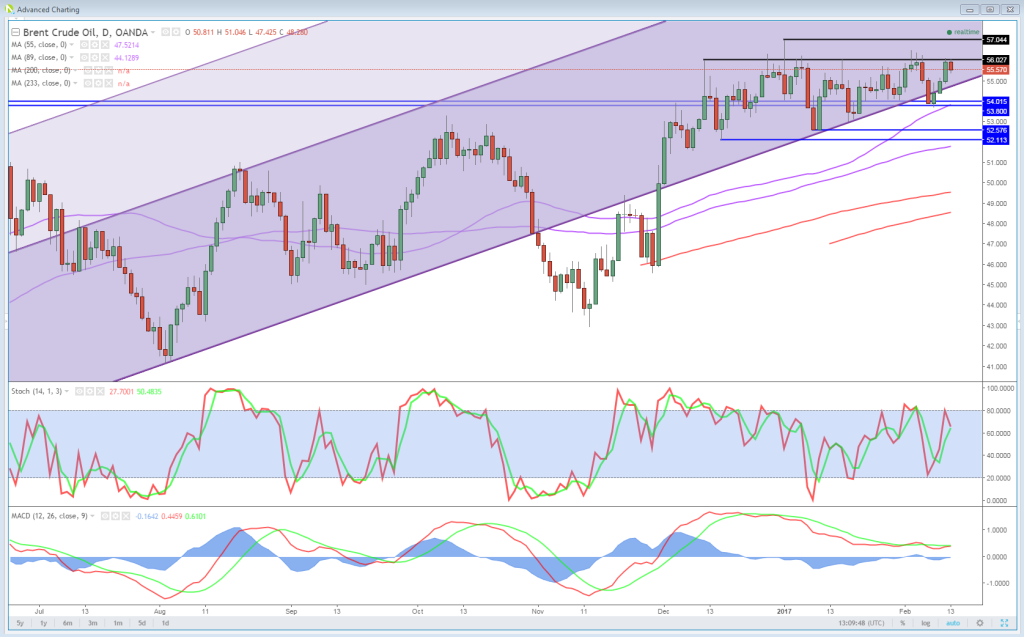

Oil has recovered some of its losses after OPEC released its monthly report which largely confirmed the report from IEA on Friday which claimed that compliance with cuts within the cartel was above 90% in January. In fact, OPEC claimed 93% compliance from the 11 members which have agreed to take part, with Saudi Arabia actually cutting more than it agreed taking its output to 9.748 million barrels per day. The report also slightly revised higher its demand growth forecasts and claimed the oil market will see zero average surplus this year, from 985,000 barrels per day last month.

OANDA fxTrade Advanced Charting Platform

While this level of compliance is unusually strong, many still believe the agreement to cut 1.8 million barrels per day until June will still not be enough to bring the market back into balance. An extension to the cuts has been touted by some including Russian energy minister Alexander Novak, who claimed the decision on whether to extend could be made at a meeting with Saudi Arabia in April or May.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.