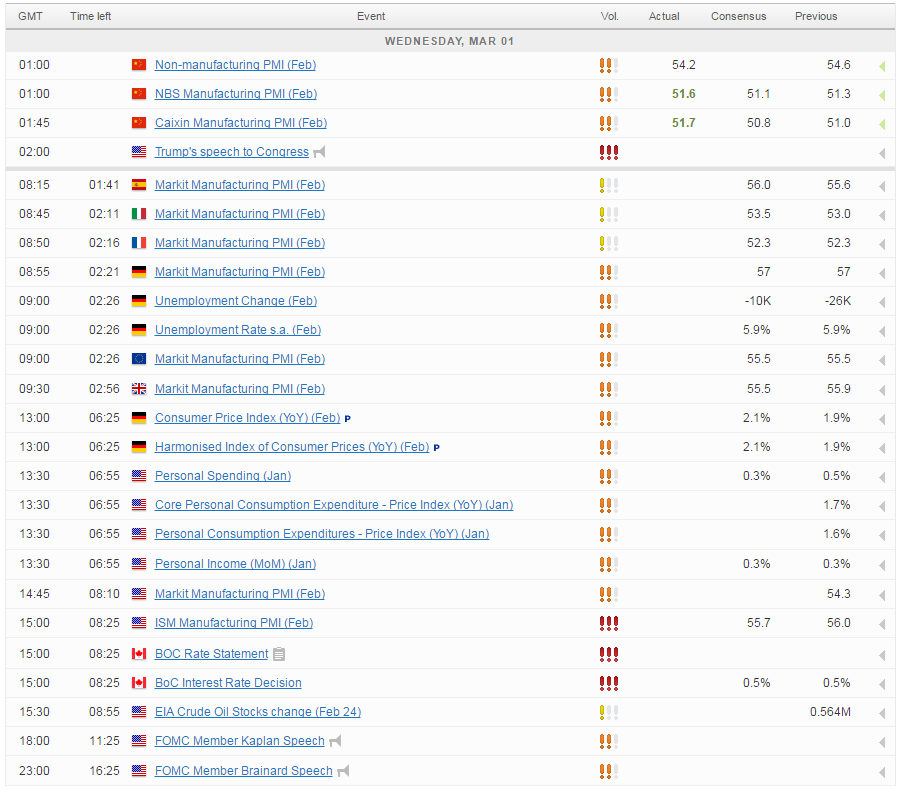

It should be quite a busy start to European trading on Wednesday, with investors having to absorb a lot of information from across the pond while at the same time manufacturing data from across Europe will come thick and fast throughout the morning.

All eyes were on Donald Trump’s appearance before Congress on Tuesday evening as investors hoped the new President would shed some detail on the “big” spending plans and “phenomenal” tax reforms that have propelled equity markets in the US to record high levels. Unfortunately, despite Trump’s more upbeat approach by his own standards, he once again stuck to his generic yet bold pledges which as of yet, don’t appear to have disappointed investors too much.

Trump Blows Trumpet But Is Light On Detail (Again)

While it’s understandable that these things take time to plan and implement properly, markets have been way ahead of the game since Trump’s victory and there comes a time when we need to know exactly what they’re rallying on. It will be interesting to see what the lack of detail in Trump’s address does to the rally’s momentum, with the Dow having already snapped its 12 day winning streak ahead of the President’s speech.

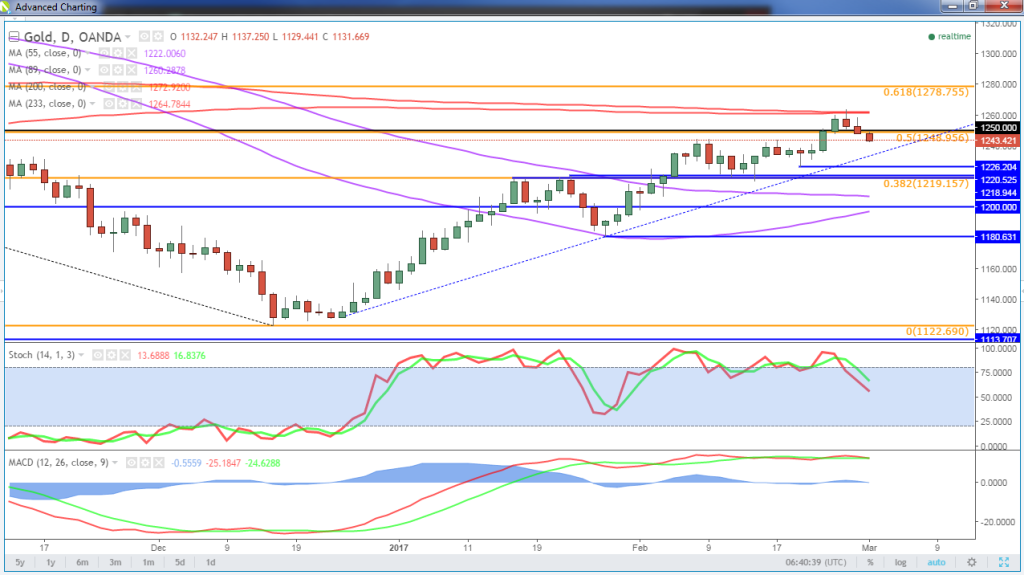

Gold Jumpy Ahead of Trump’s Congress Debut

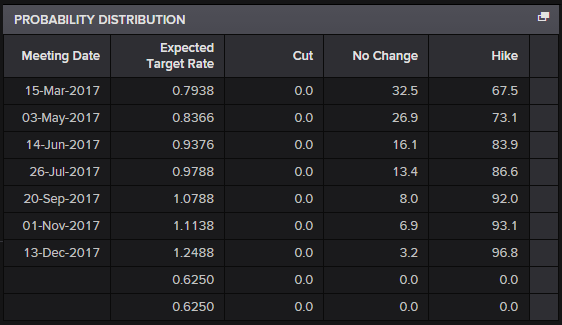

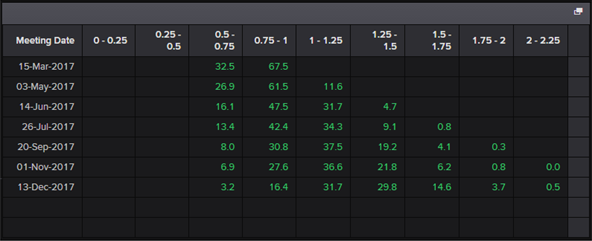

The markets are actually far more interested in what the US central bank had to say on Tuesday, with William Dudley and John Williams striking quite a hawkish tone and achieving something others, including Chair Janet Yellen, have failed to do, putting a March rate hike firmly on the table. Markets had previously not fully bought in, or come close for that matter, but with implied rate hike odds from Reuters now at 66% this month, it would appear these comments really struck a chord with investors.

Dudley – a permanent voter on the FOMC – claimed the case for tightening is now a lot more compelling, while Williams –who doesn’t vote until next year – claimed a rate increase is up for “serious consideration” at the meeting this month. The greenback has been boosted considerably by these comments and should the dollar index break through 101.75 on the back of them, we could finally see it regain its upward momentum. Gold naturally suffered following these comments after earlier in the week failing to hold above $1,260, a move that could have propelled it back towards $1,300.

OANDA fxTrade Advanced Charting Platform

There’s plenty of action still to come today including manufacturing PMIs throughout the morning from around Europe – which follows two strong manufacturing PMIs from China overnight – as well as income, spending, inflation and manufacturing data from the US. The Fed will remain in focus as we hear from Robert Kaplan and Lael Brainard – both FOMC voters – and we’ll also get oil inventory data from EIA.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.