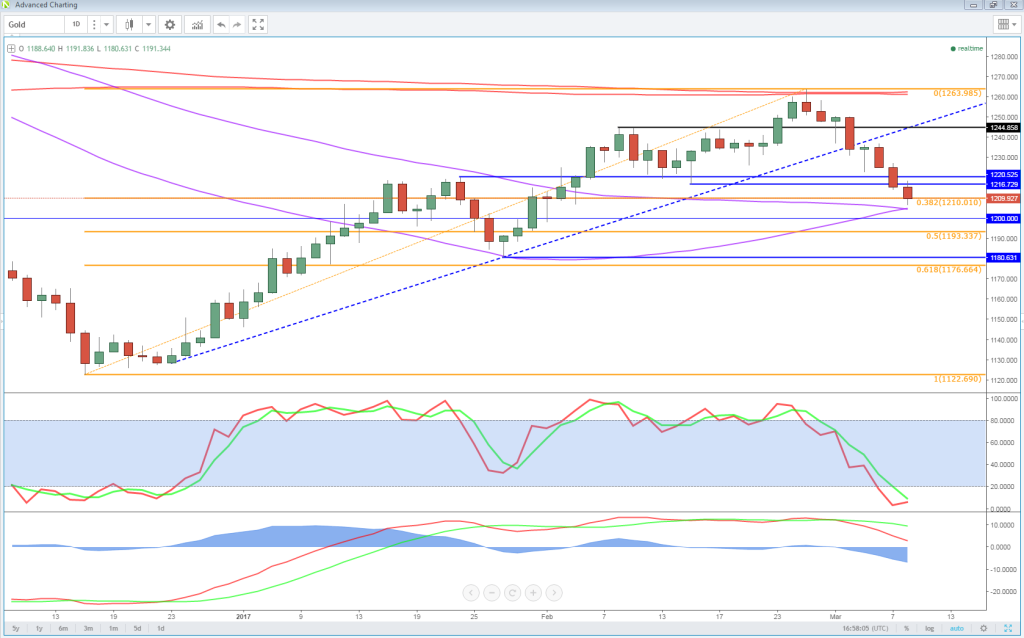

Despite the month being only a little over a week old, it’s been a torrid March for Gold so far with the yellow metal erasing its entire February gains and looking vulnerable to further downside if it can’t halt the sell-off very soon.

Gold is currently down more than 3% for the month, a move that followed it reaching its highest level since 11 November, at the end of February before running into resistance from the 200 and 233-day simple moving averages.

OANDA fxTrade Advanced Charting Platform

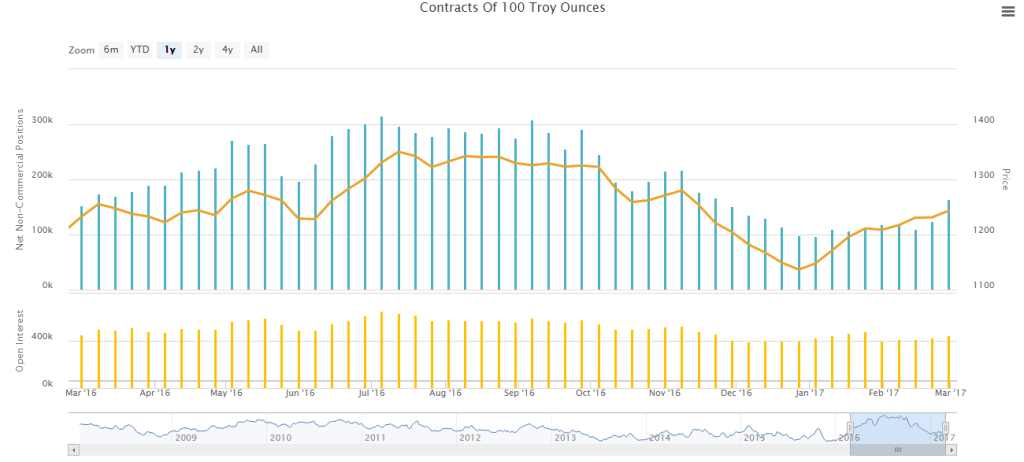

Interestingly, as you can see from the Commitment of Traders Report below, non-commercial positions at the end of February were the longest they’ve been since November and we saw a particularly large jump in the final week of the month, which could have been seen by some as a bullish signal.

Instead, what we saw is momentum actually falling out of the move as we hit the last high – $1,263.99 – with the MACD histogram and stochastic creating a divergence with price, followed by a break of a speculative trend line (only two points touching) before gathering momentum lower.

The next test for Gold was around $1,220, with this level having been a key resistance and then support area on the way up. Despite holding at the first time of asking, we broke below here a couple of days later and yesterday closed below which could open up another move lower.

USDJPY – Has it Got a New Lease of Life?

The next test for Gold is $1,205, where the 55 and 89-DMAs cross – which has held at the first time of asking – followed by $1,200, which may offer psychological support.

The next major test though comes around $1,180 which markets the low from 27 January and falls around the 61.8% retracement of the move from the December lows to the end of February highs. A break below both of these could be a very bearish signal for Gold.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.