US equity markets have spent the last week in correction mode following a fantastic run throughout February, but futures suggest they could open higher on Friday in a sign that traders may be expecting some good numbers from the US jobs data today.

The February jobs report could be the final piece of the puzzle as the Federal Reserve prepares to meet next week to discuss whether to raise interest rates for the first time this year. The coordinated comments from Fed policy makers is recent weeks has been like interest rate hike roadshow, with officials clearly determined to sell the idea to the markets ahead of the meeting. Markets until that point had completely written off such a scenario but have since responded to the barrage of hawkish commentary from Fed officials.

Given the recent efforts from policy makers, I think the jobs report today will be largely irrelevant when it comes to the discussion on interest rates next week. The figures today will literally have to be terrible in order for the Fed to consider postponing a hike that has only been made possible because of their determination that it could happen. The possible credibility cost is great enough that the Fed will not want to disappoint unless it feels it absolutely necessary.

What’s more, the ADP number on Wednesday would suggest there’s nothing to worry about. While this isn’t always a great estimate of the NFP number, it does tend to be a decent indicator of market expectations being either way too high or low and coming in more than 100,000 above expectations certainly falls in that bracket. A lot of people will have raised their expectations on the back of the ADP release but even if NFP now fails to live up to them, I very much doubt it will be bad enough to cast doubt on a rate hike next week which should offer support for the US dollar.

Gold Dips Below $1200, US Nonfarm Payrolls Loom

Other aspects of the report are arguably more important, such as average hourly earnings which tend to rise when the labour market is as tight as the unemployment number would suggest. Earnings have been steadily rising over the last two years but are still doing so at a slower pace than the Fed would like and expect if inflation is going to rise in line with its expectations. The stubbornly low participation rate may go some way to explaining this along with other structural issues but I think the central bank will be comfortable as long as the direction of travel continues as it has since the start of 2015.

OANDA fxTrade Advanced Charting Platform

Brent and WTI crude is paring losses today having suffered considerable losses over the last few days. It would appear the substantial long speculative positions have been pared back over the last 48 hours which may bring some stability back to the market but ultimately, what’s happened is a worrying sign for oil and more importantly, those countries that have agreed to cut production in order to support prices. An extension beyond the middle of the year appears to be required to prevent oil slipping further but this is far from guaranteed with Saudi Arabia appearing to lose it patience and non-OPEC compliance not seeming to match that of OPEC members.

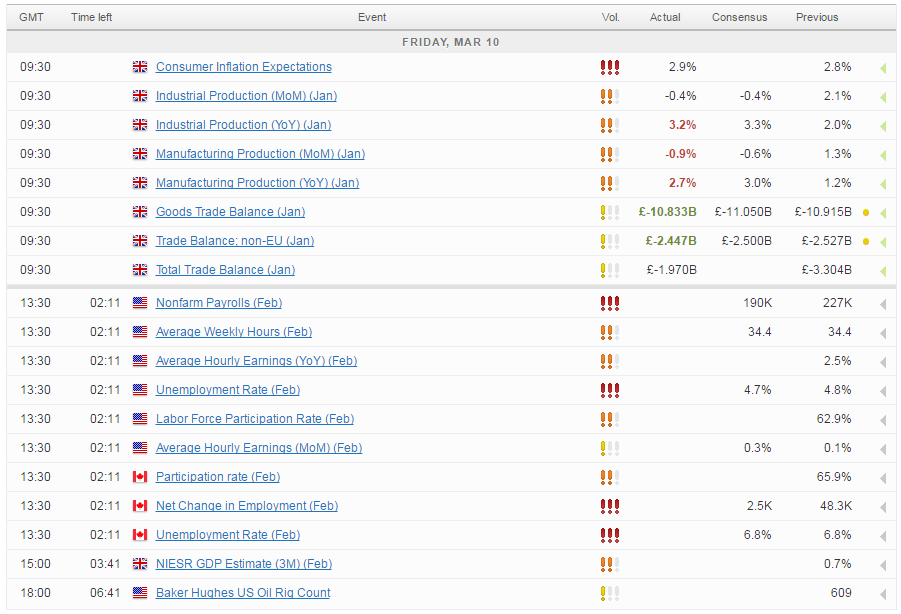

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.