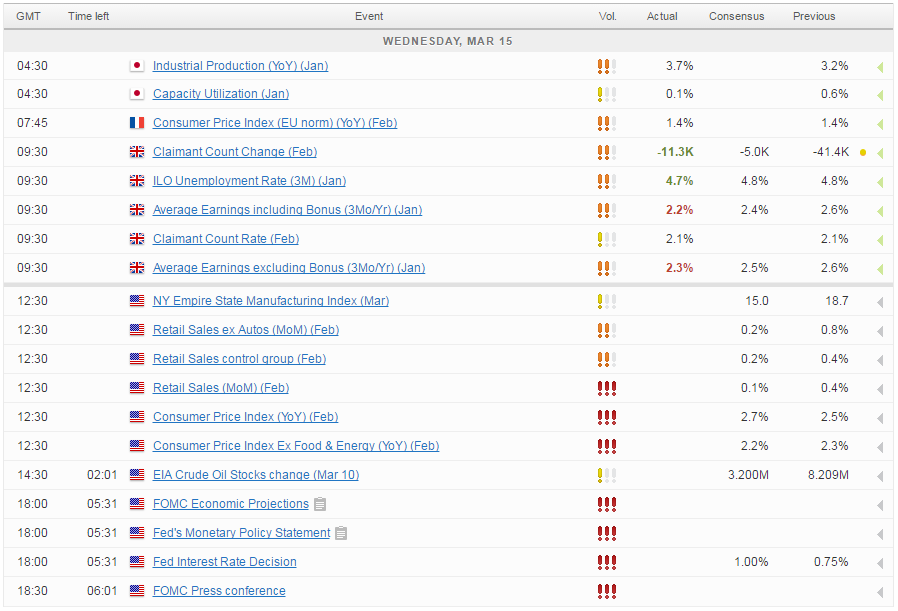

Ahead of today’s highly anticipated FOMC decision, US equity markets are expected to open a little higher with the rally in commodities seen supporting the indices while overall caution is likely to remain.

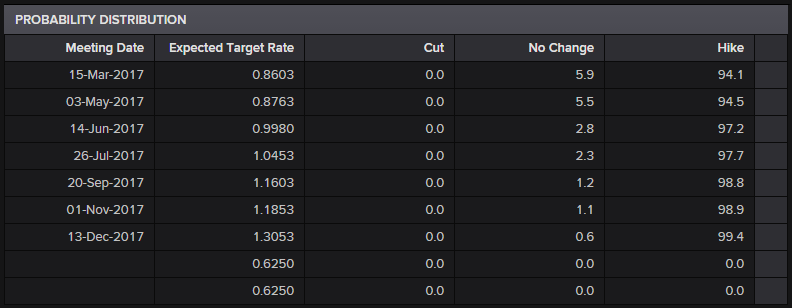

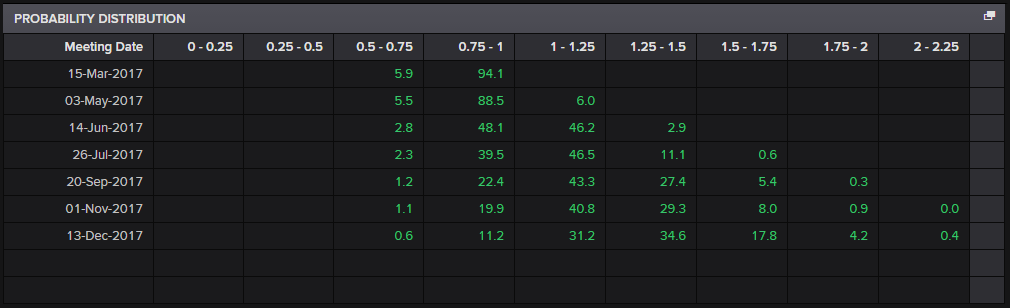

It’s quite clear that investors have been gearing up to today’s decision from the US Federal Reserve ever since the blackout period began a little over a week ago. Market expectations have been raised dramatically ahead of the meeting by a coordinated onslaught of hawkish commentary from policy makers, to the point that a rate hike is now around 94% priced in. The upside on the hike itself therefore looks very limited which means we’re relying on the dot plot and Janet Yellen if we’re going to see much of a strengthening in the US dollar or Treasury yields.

Source – Reuters Eikon Terminal

Is sudden hawkish stance a sign that Fed now sees four hikes this year?

I do wonder whether the sudden coordination from policy makers was driven by the belief that four rate hikes will be needed this year, an outcome that is only around 22% priced in at the moment. A rate hike now and another in June would certainly leave the door open to four increases and stop the Fed falling behind the curve if the US economy does respond strongly to either Trumps stimulus plans – should they be enacted this year – or the prospect of them. If the dot plot points to four hikes then I think the dollar may have further to run, if not then we could be perfectly in buy the rumour sell the fact territory.

USD/CAD – Canadian Dollar Quiet Ahead of Fed, US Consumer Data

Oil rebounds as inventories fall and Saudi’s reaffirm commitment to market stability

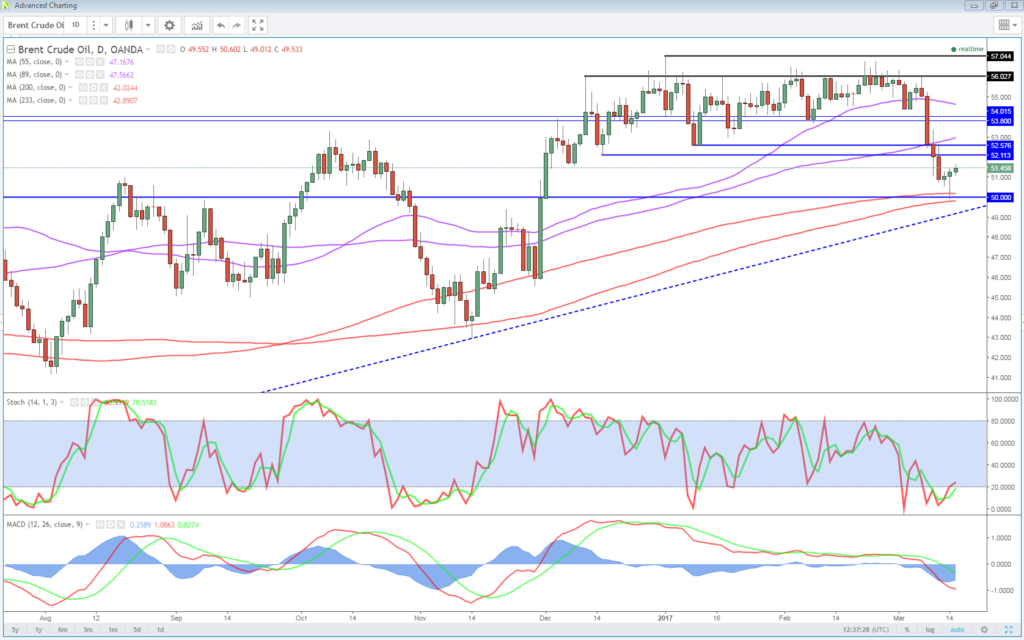

It’s not just the Fed decision that people are focused on today, although a quick look at the markets would suggest it is the dominant event for investors. Commodities are performing very well so far today, with oil in particular buoyed by Tuesday’s surprised inventory drawdown, as reported by API, and Saudi Arabia’s commitment to oil market stability. The commitment came after the OPEC report showed Saudi output actually increased in February although this was brushed off as being for storage purposes. An extension of the output deal between OPEC and non-OPEC members remains in doubt but the inventory numbers and Saudi energy ministry comments have afforded oil the opportunity to stabilise. It’s been quite an aggressive sell-off in oil since the start of last week and a correction is good for the market. The fact that this came as Brent crude closed in on the psychologically significant $50 is no real surprise.

OANDA fxTrade Advanced Charting Platform

Dutch election could be the canary in the mine ahead of the French election

There’ll also be a close eye on the Netherlands over the next 24 hours, as the country heads to the polls and we get an idea of just how strong the populist vote has engulfed the eurozone after years of problems. The Dutch election is effectively the canary in the mine for investors as, while Geert Wilders – the eurosceptic far right leader – has led many polls, the fragmented nature of the Dutch parliament combined with the inability of Wilders to find any parties to join a coalition, makes it very unlikely that he will rule. That said, the trend of polls underestimating the populist vote – as we saw last year in the UK Brexit referendum and US Presidential election – would favour Wilders and should we see similar results today, it would cause great concern ahead of the French election over the next couple of months as Marine Le Pen actually stands a realistic chance of winning.

Sterling volatile as Sturgeon runs into referendum difficulties and jobs data highlights weaker wage growth

It’s been a bit of a rollercoaster ride this morning for the UK, with the pound initially boosted by Nicola Sturgeons acknowledgement that Scotland would probably not seek to join the EU right away in the event of a vote for independence, instead suggesting they could follow a Norway-type model. This came as a number of polls suggested Scots would once again vote to remain, just as they did a couple of years ago. This would be a crushing defeat for Sturgeon and the SNP and it would appear a sudden change of tactics will be necessary if they’re going to avoid the same outcome as before. The pound did take a hit today after UK jobs data showed that while the unemployment situation still looks good, wage growth is slowing which, coming at a time when inflation is headed in the other direction, doesn’t bode well for the UK’s consumer driven economy.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.