Equity markets in Europe are trading a little mixed on Tuesday, offering little direction for US futures ahead of the open on Wall Street, while commodities are broadly in the green as oil looks to extend its winning run to five straight session. There’s been some interesting moves in currency markets this morning, with sterling being particularly volatile on the back of some interesting inflation data.

GBP Spikes After Inflation Data Before Quickly Spiraling Lower

This morning’s UK CPI data caused quite a stir for the pound, with the spike in headline and core inflation in April initially sending the currency higher before almost immediately spiralling lower. As always, there’s a number of things to consider here, which would explain such a strong reaction. The above expectation spike in inflation is typically bullish for the currency, especially when the rate is already above the central bank’s target. Add to this the sheer size of the jump and the BoEs acknowledgement last week that “some MPC members would need relatively little upside news on growth or inflation to consider voting for tighter policy” and the initial spike will perhaps seem justified.

DAX Flat as German Economic Sentiment Misses Estimate

That said, there are other things to consider here, not least the fact that Easter this year fell in April rather than March, therefore the year on year comparison is naturally skewed to the upside. The 18.6% increase in air fares which largely contributed to the rise in transport prices is a clear indication of this. The other thing to consider here is that the BoE will likely have been aware of the spike in April when it released its new forecasts and made its decision last week, so from a monetary policy perspective, little has probably changed. Finally, with the pound already struggling around 1.30 against the dollar, the sell-off that followed to levels well below where it was prior to the release is an indication of an exhausted rally that’s possibly crying out for a correction. Given the size of the moves we’ve seen over the last month, this could easily be what we’re seeing, having failed repeatedly at the recent highs.

OANDA fxTrade Advanced Charting Platform

EURUSD Hits Six Month High and Further Gains Could Lie Ahead

The euro on the other hand has had a much more positive start to the day, breaking and holding above 1.10 against the dollar to trade at its highest level in six months. The ZEW economic sentiment figures were broadly supportive for the euro – despite the pause that initially followed it – with economic sentiment in Germany rising, albeit less than expected, while the eurozone as a whole rose to a near two year high. This morning’s break could be significant for the pair, with 1.1125-1.1150 being the next big test for the pair.

Trumps Political Gaff Has EUR Soaring

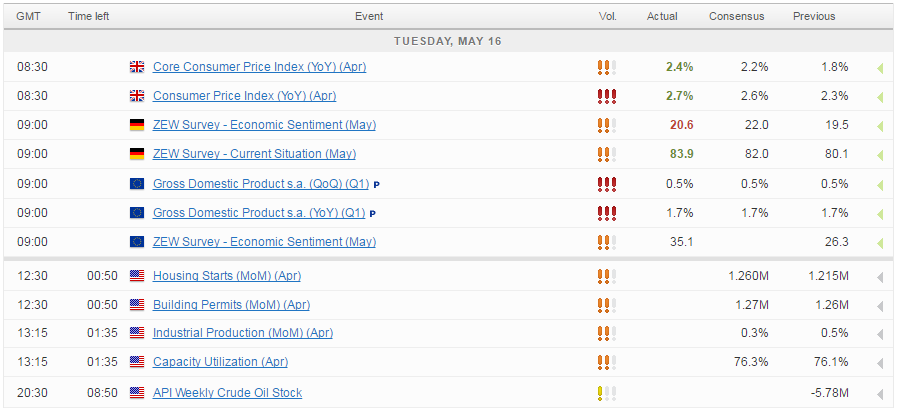

There’s still more to come on the data front, with building permits, housing starts, industrial production and capacity utilization figures all due for the US.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.