US equity markets are expected to open slightly lower after the long bank holiday weekend, with traders looking to the income, spending and inflation data from the US to spark things back to life.

US Inflation, Income and Spending Key Ahead of June Fed Meeting

With markets still heavily pricing in a rate hike at the next meeting in a couple of weeks, there is the potential for disappointment yet again today. The upward revision to first quarter growth may have settled people’s nerves a little but a weak inflation report today could raise questions ahead of the June meeting. We’ve already had some policy makers raising concerns about the lack of inflation and a weak number today may be just enough to convince them to hold off on raising rates for a little longer.

CAC Ticks Higher on Mixed French Numbers

The income and spending data will also be of interest, with consumer activity of course being so important for the US economy. Both income and spending are expected to have grown by 0.4% in April which is consistent with the retail sales data and comes following a very disappointing first quarter. Strong figures today would be consistent with the current Fed belief that the slowdown in the first quarter was transitory, as it proved to be over the last few years.

Draghi’s Monetary Support Comments and Greek Speculation Weigh on EUR in Early Trade

The euro has been under some pressure this morning, particularly against the yen which has strengthened across the board, with comments from ECB Mario Draghi and Greek loan repayment reports weighing on the currency in early trade. Draghi’s claim that the eurozone still needs an extraordinary amount of monetary support would suggest the central bank may not be as keen to reign in its stimulus program as has been speculated. That said, the scale of the sell-off combined with the rebound we’ve already seen, would suggest investors still expect further reductions in stimulus later this year.

Euro Geopolitical Fears Sap Risk Appetite

The rebound has also be aided by a Greek government spokesman denying reports over the weekend that the country is considering opting out of its loan repayment in deny unless lenders come to an agreement on debt relief next month. Debt relief continues to be a major sticking point for negotiations, with the IMF insistent that something must be done in order to make the county’s debt sustainable. Of course, this still remains a controversial issue, particularly in Germany where the public will head to the polls later this year. Should Angela Merkel come to an agreement on debt relief just ahead of the election, it could be damaging for her so it’ll be interesting to see how she gets around it.

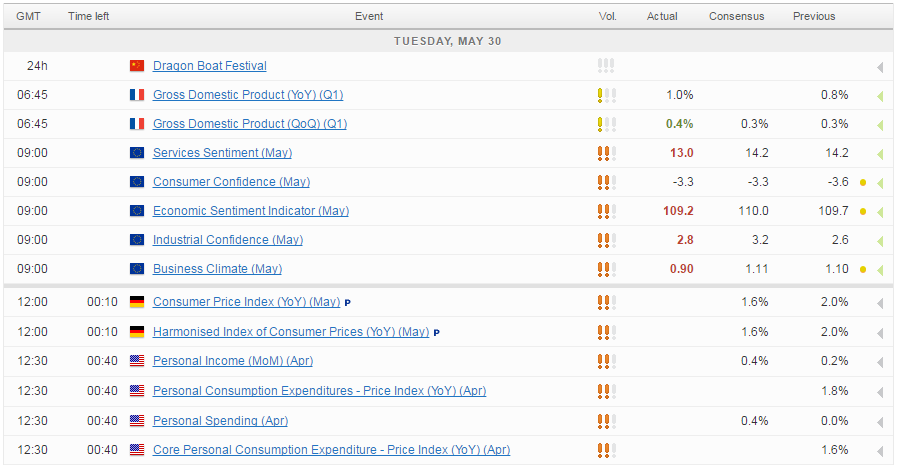

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.