Super Thursday in the UK is rarely a dull event and this week is certainly going to be no different, as policy makers at the Bank of England grow increasingly divided on the topic of interest rates.

Uncertain BoE Outlook Could Spur Volatility on Thursday

The job of the Monetary Policy Committee has been made increasingly difficult since the EU referendum, with inflation having surpassed its 2% target at a time when the economy is slowing and the uncertainty over the outcome makes forecasting extremely difficult.

This has created divisions within the committee over whether to raise interest rates to keep a lid on inflation and risk hurting the economy, or allow inflation to run a little higher in the short term and support the economy through this tough period. With the committee split, things could get quite volatile in the markets as we try to establish what all this means for interest rates in the coming years.

GBP/USD – Pound Shrugs Off Soft UK Construction PMI, BoE Rate Decision Looms

At the last meeting, the committee voted 5-3 in favour of leaving interest rates unchanged, the closest the vote has been for such a move since May 2011. This happened despite people only expecting one vote in favour of a hike and showed that the committee was far more divided than markets had anticipated.

Not only that, Andy Haldane – Chief Economist at the BoE – voted in favour of keeping rates unchanged at the last meeting but has since suggested he could vote for a hike if data comes in as expected.

Source – The Telegraph

While one dissenter – Kirstin Forbes – has since left the committee, the vote remains too close to be in any way certain about what action the central bank will take.

What is the Market Expecting?

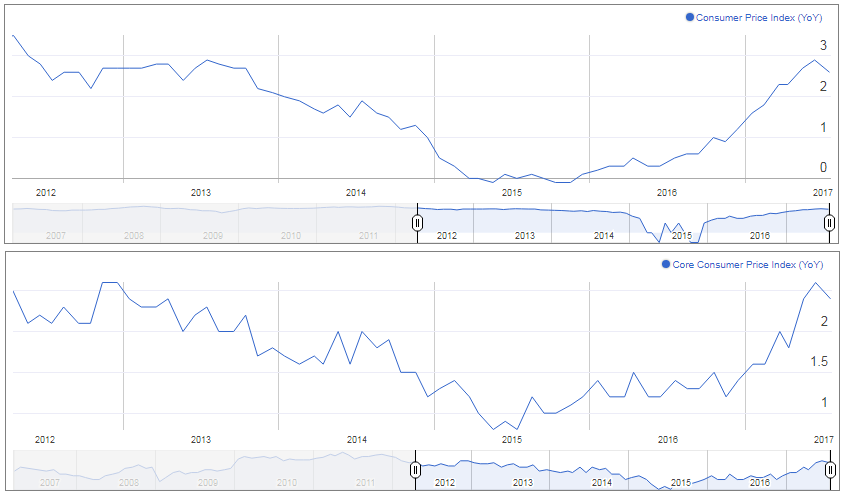

Still, the market is only pricing in an 8% chance of a 25 basis point rate increase on Thursday. The drop in inflation last month from 2.9% to 2.6% (2.6% to 2.4% for core) is likely the reason for this, with the cooling in price pressures alleviating the pressure on policy makers to raise rates.

This all assumes that the inflation data was in fact the main reason behind the decision to favour a rate hike and that similar noises coming from other central banks in recent months in just a mere coincidence. While a rate hike on Thursday seems unlikely, it may well be the case that the desire among some policy makers to raise interest rates hasn’t actually faded as much as you’d think.

The fact that the pound isn’t too far below the levels it traded at prior to the latest inflation data – as are yields on UK debt – may suggest that traders still expect the BoE to maintain a more hawkish stance than it did earlier this year and stand ready to hike. This may all become clearer on Thursday.

Oil Slides Ahead of Inventory Data

Not only do we have the monetary policy decision and the minutes to contend with, but as it’s Super Thursday a press conference with Governor Mark Carney and his colleagues, and the quarterly inflation report will also accompany them. Needless to say, an uncertain monetary policy outlook combined with all of this should ensure we have plenty of volatility in GBP, UK Bonds and the FTSE on Thursday.

To hear Craig’s thoughts on this and get his analysis on GBPUSD, EURGBP, GBPJPY, GBPCAD and UK100 (FTSE 100), check out our BoE Super Thursday preview video below.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.