Should We Be More Concerned About North Korea Retaliation to UN Sanctions?

US indices are poised to open in, or close to, record territory on Tuesday as North Korean fears continue to subside.

Once again we find ourselves in a scenario in which no news is good news and while underlying risks remain, the longer we go without another nuclear or missile test, the more positive investors will become. The only problem with this is that, with the UN having just agreed on new sanctions against North Korea – spearheaded by the US – I wonder how long we will have to wait for an act of provocation in response.

With that in mind, I expect an element of caution to remain, at least until after the weekend at which point investors may decide that such a response isn’t imminent. Should we get a response, then I would expect to see a similar response as we’ve seen in recent weeks, with traders once again favouring safe havens such as Gold, which despite having come off its highs, currently remains elevated.

EUR/USD – Euro Dips Below 1.20 as Risk Appetite Returns

UK Inflation Spikes Again Ahead of BoE Meeting

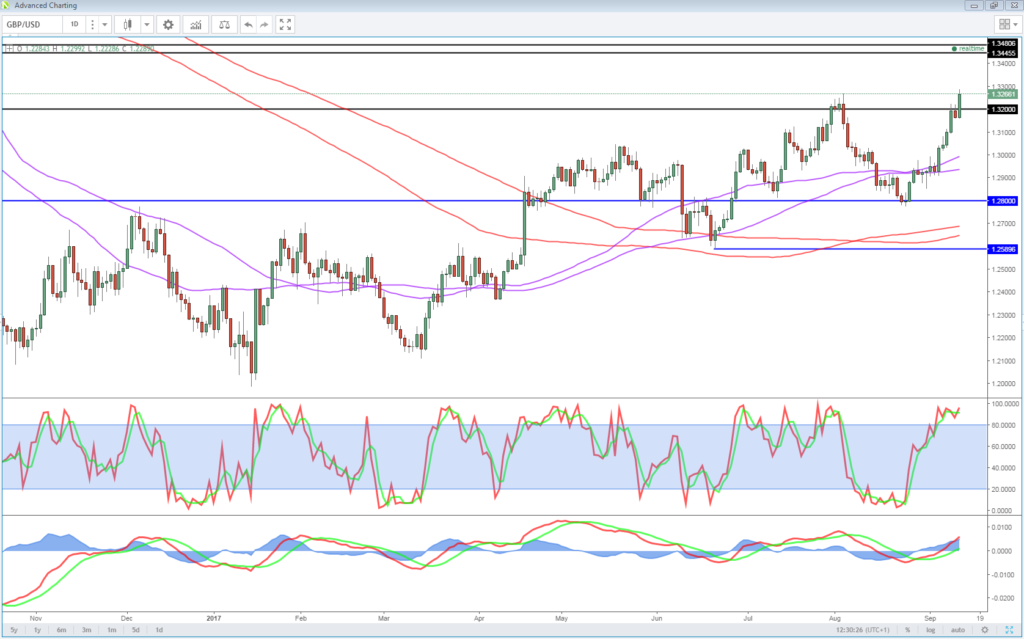

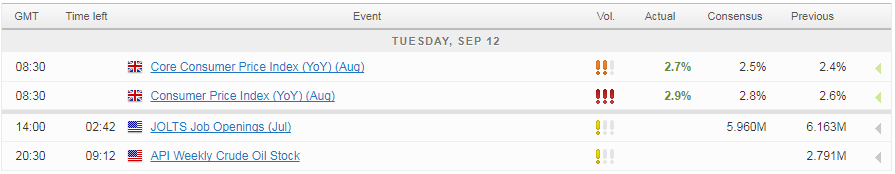

In the meantime, attention will turn back to the fundamentals and this week, that is focused primarily around the UK, with data releases earlier in the week followed by the Bank of England monetary policy meeting on Thursday. Today we got the first of the releases – CPI and core CPI data – which showed prices in the UK rising at a faster pace than expected and a much faster pace than the BoE targets.

This has created a dilemma in the past for the BoE – as demonstrated by the lack of consensus in the voting in recent months – with policy makers being torn between raising interest rates in order to bring inflation back towards target and protecting the economy and hoping it naturally finds its way back to target. The latter of these strikes me as the most sensible, with price rises having largely been driven by the depreciation of the pound, the bulk of which should now be behind us. Clearly though, some policy makers are not convinced this is the case. With labor market data still to come before Thursday’s monetary policy decision, it will certainly be an interesting week for the UK economy and the pound, which rallied after the inflation data on the expectation that the it adds to the case for a hike.

OANDA fxTrade Advanced Charting Platform

US Labor Market Should Be Primed For Wage Growth

The bulk of the US data isn’t due until later in the week, at which point we’ll get inflation and retail sales figures, both of which will closely monitored. Today’s we’ll get JOLTS job openings data for July which is expected to have come slightly off its June high but remain just below 6 million, a sign that the labor market remains extremely healthy and primed for stronger wage growth which has so far proved elusive.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.