NFP Headlines Big Data Week

It promises to be another very busy week in the markets, with particular focus falling on the economic data, the most notable will come on Friday in the form of the US jobs report.

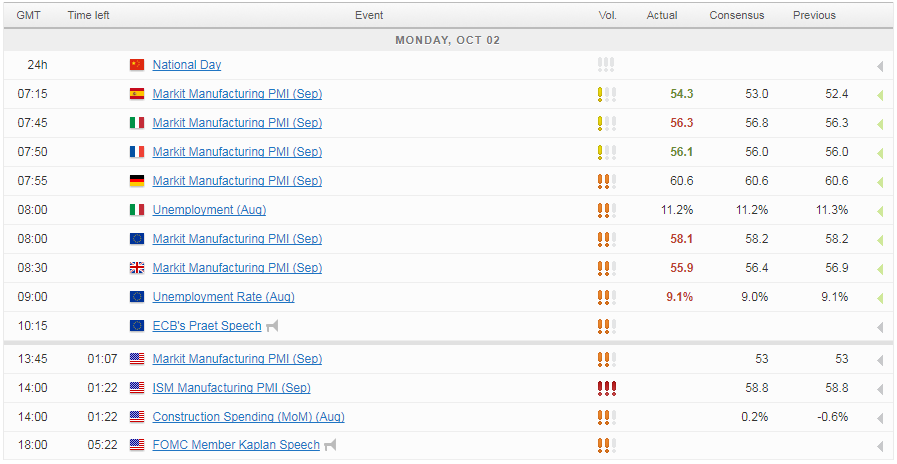

We’ll also get a few notable releases on Monday, with the official and ISM manufacturing PMIs being released alongside construction spending figures. Federal Reserve policy maker and FOMC voter Robert Kaplan is also scheduled to appear today and is one of a number of officials due to speak this week.

Chaos as Catalans Vote For Independence

The illegal Catalonia independence referendum went broadly as expected over the weekend as voters turned out and clashed with Spanish police, who had been tasked with stopping the vote taking place. While hundreds of people were injured in the clashes, a large number of people managed to cast their vote and it’s claimed that 90% of those that did voted for independence.

While the vote isn’t legally binding, traders are clearly a little concerned about the impact that the vote, not to mention how the situation was handled by the Spanish authorities. The IBEX is the worst performing major index in Europe on Monday, down more than 1%, while the euro is also suffering in the aftermath of the vote, down more than half a percent against the dollar.

EUR/USD – Euro Starts Week Lower After Catalonian Chaos

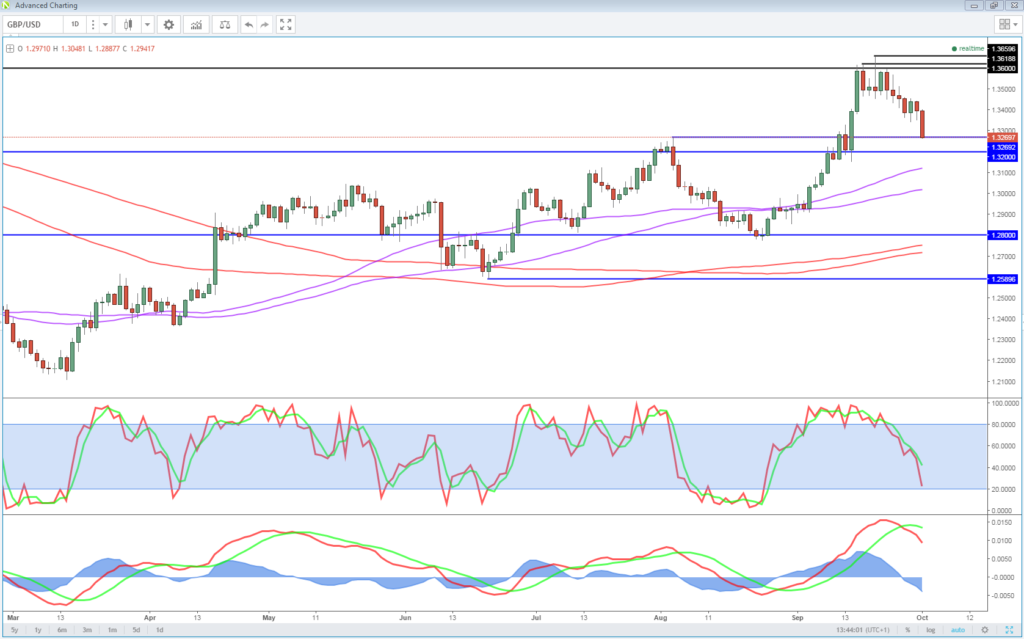

Sterling Slips After PMI as Conservative Party Conference Gets Underway

There’s been a flurry of economic data releases already today, with manufacturing PMIs being released for countries throughout Europe. The data was broadly in line with expectations, with the Italian reading missing slightly and the Spanish coming in a little above. The UK manufacturing PMI slipped a little more than expected, dropping from 56.7 to 55.9, further weighing on the pound this morning.

OANDA fxTrade Advanced Charting Platform

Sterling is coming under a little pressure as the Conservative party conference gets underway in Manchester. Concerns about division within the party on both the Brexit strategy and Theresa May’s position as leader continue to paint the picture of instability within the Conservatives, following what was a disastrous election campaign that saw them unnecessarily concede their majority. We’re likely to hear plenty of murmurings over the coming days and there’ll be particular focus on speeches from May and Boris Johnson who has repeatedly undermined her on Brexit and is clearly vying for her position.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.