Will Dips Being Pounced on After Profit Taking?

Fresh record closes in US equity markets barely count as news nowadays, but a day after having done just that, major indices are on course to open around 0.2% lower this morning.

The declines in US futures track similar moves in European equity markets which are suffering a lack of direction in what has been a very slow news week, from a markets perspective. While indices have still managed to eke out new highs despite a complete absence of catalysts, the moves have been very small, even by the current stock market standard, and it would appear this has encouraged some profit taking from investors.

That’s not to say these declines will be sustained – the evidence suggests the buy the dip mentality is alive and well in the markets – but any corrections, however small, will likely be welcomed by investors who crave some more volatility in the markets. Perhaps the reports of delayed implementation period for corporate tax cuts has taken some of the shine off the rally but I don’t think it will make much difference, as long as it ultimately passes.

Donald Trump’s Asia visit has had little impact so far on markets, with the US President having pretty much kept to the expected script of fairer trade and a tougher stance on North Korea. As was the case with Trump’s previous visit to the Middle East, he appears to have mostly stuck to the script and caused no alarm or controversy as a result, something that is not always the case when at home. As long as this remains the case, the visit will likely pass without attracting much attention in the markets.

DAX Edges Lower Despite Sharp German Trade Surplus

As far as the US is concerned, the vast majority of the most important economic events took place last week, with earnings season now drawing to a close, a new Federal Reserve Chair having been announced, tax reform details having been released and the Fed meeting having concluded without any changes. That’s left us with very little to focus on this week and today is no different. The only notable release today will be the weekly jobless claims.

Brexit Talks Resume as Negotiations Move at Snail’s Pace

Over in Europe, UK and EU negotiators will once again prepare to meet for Brexit talks today, although if previous discussions are anything to go by we shouldn’t be optimistic on much progress being made. Still, with time fast running out for the two to move onto trade and transition discussions before companies start implementing contingency plans in case of worst case scenario no deal, we may hopefully start to see some progress on the Brexit bill, citizens right and the Northern Ireland border. Although as we’ve seen repeatedly over recent years with Greece in particular, these things have a knack of being resolved at the eleventh hour.

It will be interesting to see how vulnerable the pound is to negotiations as we near the end of the year, which is the point at which many companies have signaled clarity on the future relationship will need to be made known. I would imagine the pound would come off worst in the situation that we’re no further on than we are now in a couple of months’ time.

Dollar’s Mixed Fortunes and Equities Wild Swings

UK GDP Data Due as EC Downgrades Forecasts

On the UK side we will get some GDP data today, with NIESR releasing their estimate for the last three months. This comes as the European Commission earlier today released their economic forecasts and lowered their growth expectations for the UK this year to 1.5% and predicted it to be one of the slowest growing economies in the EU in 2019.

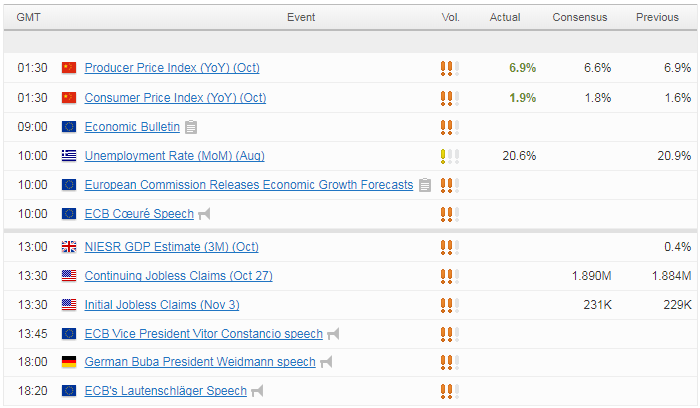

Source – Thomson Reuters Eikon

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.