Vienna readies for OPEC decision day as markets see a final shuffling of the positioning chairs before today’s fireworks.

Crude oil had a very choppy session overnight as the street chased its tail back and forth on rumours and headlines ahead of today’s official OPEC meeting in Vienna. Both Brent and WTI traded in 2.50% ranges, but as the dust settled both contracts closed only slightly down on the day. Both were falling 30 cents to 63.05 and 57.25 respectively.

Asia has unsurprisingly, taken a look at the overnight ranges and concluded that things are best left well alone until where hear from OPEC and Non-OPEC later today. Both contracts trading uncaged in the early part of the session.

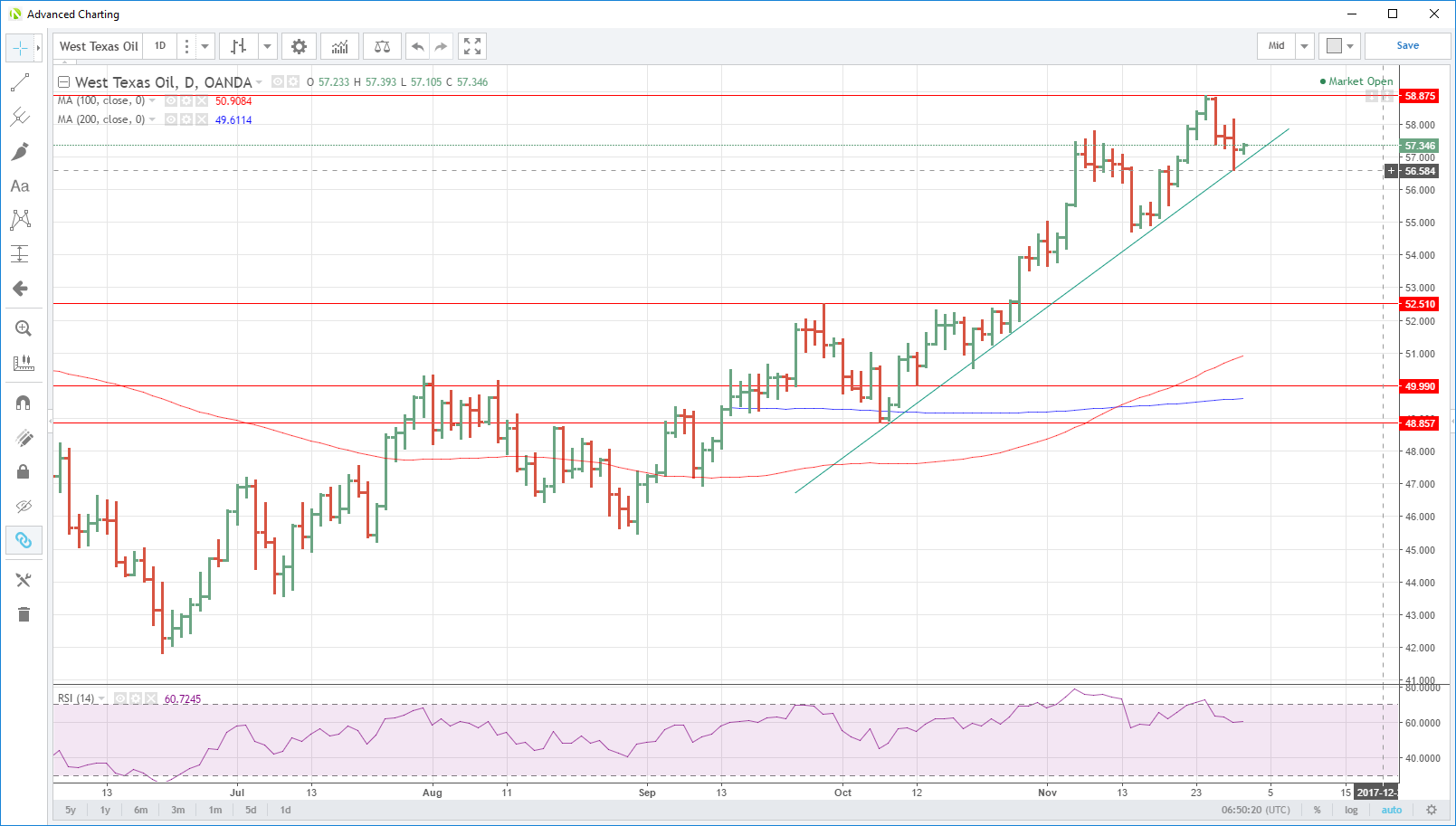

The technical outlook paints a somewhat darker picture though. Brent broke its short-term trendline on Monday and never recaptured it. It has now formed a formidable series of double tops above building strong resistance. WTI held its two-month trendline support overnight, barely staying above it this morning. The takeaway from this is that a nine-month extension of the production cut deal is priced in and anything less from Vienna today could see some uncontrolled spills in prices as long positioning runs for the exit door.

Brent

Brent Crude has double tops at 64.00, 64.45 and 64.85 to overcome now forming a serious zone of resistance to further rallies. Support is at 62.00, followed by the two-month trendline at 61.45 and then the crucial multiple daily lows 61.25 level.

WTI

WTI has resistance at yesterday’s high at 58.25 followed by its double top at 58.85. Much more importantly, it lies just above its two-month trendline support at 56.80. Yesterday’s low at 56.60 is just behind to offer interim support, but after that, the charts open up with no technical support until 54.80.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.