Investors Seeking Further Tightening Clues

It may be a decade since the start of the global financial crisis but only this year have central banks around the world began dialling back their emergency stimulus measures, a sign that the global economy is finally starting to stand on its own two feet.

Two central banks that have joined the party this year are the ECB and the Bank of England, with the former paring back its quantitative easing program and the latter reversing its post-referendum rate cut. While this may not sound like much and leaves both a long way behind their American colleagues, it’s an important first step towards the normalisation of interest rates.

With both central banks pursuing tighter monetary policy and the global economy gathering momentum, what can we expect from the ECB and BoE on Thursday?

Investors Cautious Ahead of FOMC Announcement

Will Draghi Come Baring Gifts or Lumps of Coal?

The ECB revealed plans to extend its QE program by a further nine months in October, reducing purchases from €60 billion to €30 billion in the process and laying the groundwork for it to expire at the end of September.

While Draghi at the time would not commit to this and instead preferred to leave it open ended and data dependent, traders will be hoping that the data since then may encourage him to expand further. I’m not personally holding my breath.

Draghi likes to keep his cards close to his chest and detests the idea of backing himself into a corner. Particularly when the end result is a stronger euro and higher yields on eurozone debt, neither of which will be especially appealing.

OANDA fxTrade Advanced Charting Platform

What he may do though, if asked, is go into more detail on what the ECB will do after the end of QE. The Fed ended its QE program in October 2014 and then raised interest rates for the first time just over 12 months later. It was only three months ago that the Fed started reducing the size of its balance sheet. Will the ECB follow a similar path given how smooth the process has been for the Fed?

Will the BoE Take a Page Out of the BoC’s Book?

The Bank of Canada also started raising interest rates again this year and followed its first hike in July with a second at the next meeting in September, to the surprise of many. With the BoE having raised rates for the first time since the financial crisis last month, can we expect something similar on Thursday?

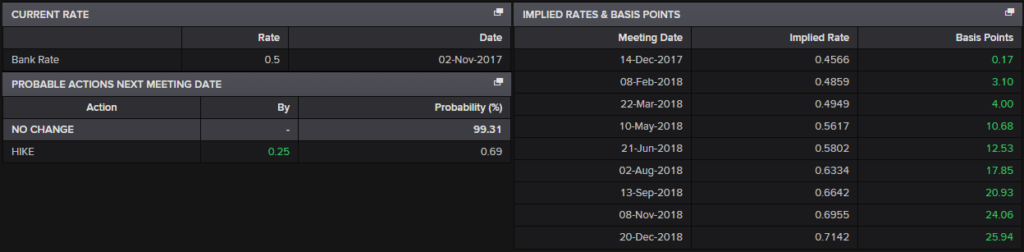

I very much doubt it. And so does the market with no hike priced at more than 99%.

Source – Thomson Reuters Eikon

In fact, I think we may have to wait at least another 12 months for a rate hike from the BoE, as we did the Fed after its first hike in 2015. Unlike the BoC, the BoE raised interest rates from a position of weakness, with inflation having being driven primarily from the post-referendum decline in sterling. Had the BoE not also cut interest rates in the aftermath of the vote, I doubt they’d have opted to hike rates last month.

With the economy far from firing on all cylinders and the outlook very uncertain, I strongly doubt that the central bank will consider more hikes in the foreseeable future. Especially as the bank rate is now back at the level the BoE deemed the lower bound for more than seven years after the GFC.

USD/JPY – Dollar Breaks Below 113 Yen Ahead as Fed Rate Hike Expected

With no press conference scheduled following the decision, we’ll have to rely and the minutes and voting to gage the mood within the Monetary Policy Committee. Expectations are for this to be less of an event than it has in previous months.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.