Markets Flat in Thin Trade

It’s been a relatively flat start to trading on Wednesday, broadly speaking, and US futures suggest more of the same is to come.

This period between Christmas and New Year is often very quiet, with politicians and central banks endeavouring to wrap everything up ahead of the holiday period. With the US having got tax reform over the line last week and kicked the budget issue back to January at the last minute, investors have been left with little to turn their attention to.

News flow aside, trade during this week is often very thin with large numbers of people taking the week off and the lack of volatility we’ve seen so far isn’t exactly drawing traders back in. With the data calendar not looking particularly full over the coming days, I don’t hold much hope for conditions improving dramatically.

DAX Loses Ground, Investors Search for Cues

Oil Off its Highs After Libya Outage

There are pockets of the market where we have seen some volatility though, most notably oil, which hit a two and a half year high yesterday on reports of supply disruptions in Libya. A reported pipeline explosion could reduce production by between 70,000 and 100,000 barrels a day, which was significant enough to trigger the surge in thin trade.

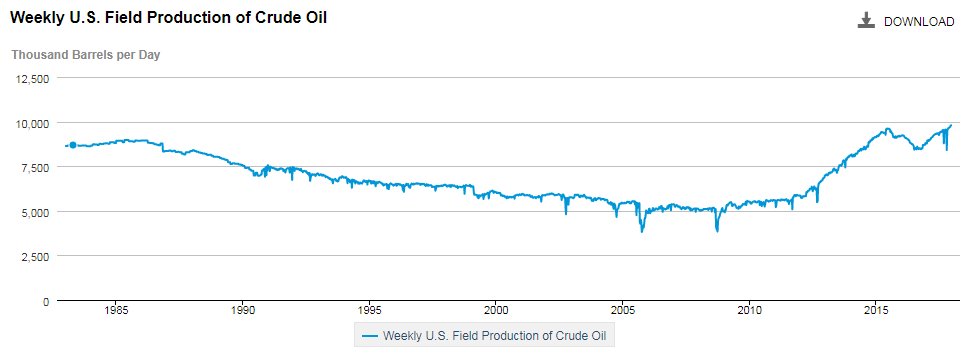

Oil prices had already been lifted by an outage in the Forties pipeline, affecting 400,000 barrels a day, although repairs have since taken place. While these stories have had temporary impacts on the oil price, I wonder how much higher prices can now go in the longer term, with efforts to rein in production having been largely priced in. US production is on the rise again which will remain a challenge for the industry and could cap any rallies next year.

Source – EIA

EUR/USD – Euro Edges Up, U.S. Consumer Confidence Next

Bitcoin Recovers But Remains Well Below Pre-Christmas Highs

Bitcoin is going to continue to fascinate traders heading into the new year and while volatility by its own standards has been tame today, it’s likely to remain very active. Speculators appetite for Bitcoin has been tested in the run up to Christmas, with price having fallen from around $20,000 to not far from half that less than a week later, depending on the exchange.

Source – Thomson Reuters Eikon

While prices have since rebounded back to around $15,000, it will be interesting to see whether we see the kind of wild gains that we’ve become accustomed to in the coming months, or whether the recent decline has shaken people’s confidence in the cryptocurrency.

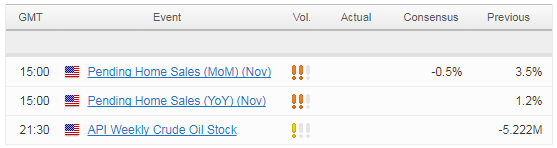

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.