US Investors Shrug Off Shutdown Concerns

As we enter the third day of the US government shutdown, index futures are pointing to only a slightly lower open on Wall Street as investors shrug off the failure to pass a last minute spending bill.

There were some concerns that the shutdown may weigh on investor sentiment and halt what has been another impressive run in US stock markets but as of yet, there’s little evidence to support this. Yes futures are a little lower ahead of the open but these declines don’t even wipe out Friday’s marginal gains which suggests that what we’re seeing is not out of the ordinary.

As long as a solution is found in reasonable time to fund government and reopen the areas that are now closed, I don’t expect investors to concerns themselves much with it. The last shutdown in 2013 lasted 16 days and had minimal, if any, lasting economic impact and it’s this that is likely giving investors the confidence to shrug it off this time around.

EUR/USD – Euro Higher, Investors Look for Cues

Earnings Season Enters Key Period as 82 S&P 500 Companies Prepare to Report

Investors will likely be more concerned with earnings season this week with 82 S&P 500 companies, including nine from the Dow 30, reporting on the fourth quarter. This is therefore one of the busiest weeks in the earnings season and should give us a much better idea of how companies performed in the last quarter, with expectations still be very high.

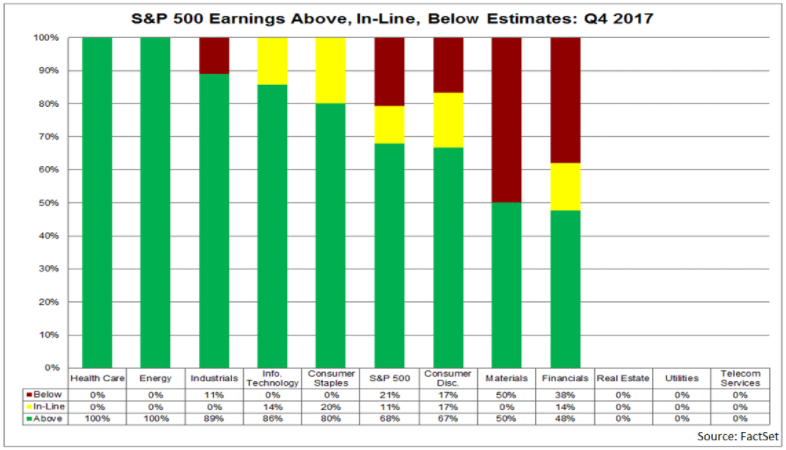

As you can see below, it’s been a good start to earnings season except for financials which is primarily due to charges and expenses related to new tax laws. With little more than 10% of S&P 500 companies having reported though, there isn’t too much to go on making the next two weeks all the more important.

Source – Factset

ECB and BoJ Monetary Policy Decisions Eyed This Week

It’s going to be a very busy week for financial markets, with the political backdrop in the US providing a constant distraction while two major central banks will make monetary policy announcements and a number of key pieces of data will be released. The ECB decision on Thursday will likely be the highlight after the minutes from the previous meeting hinted at policy makers providing insight into policy changes later this year in the coming months.

The Bank of Japan will also be closely monitored after the central bank earlier this month bought slightly fewer bonds than it has in the past, fuelling speculation that it could be preparing to reduce its stimulus measures despite having claimed previously that it would not be doing so. The central bank may utilise this meeting to clarify its position and reassure investors.

Central Banks Key to Dollars Short Term Direction

Bitcoin Off to a Rocky Start Again

It’s likely to be another volatile week for bitcoin and other cryptocurrencies. Bitcoin staged a slight comeback after a rough start to last week but once again it appears to be struggling to gather any upward momentum. It is currently trading at around $11,500, having fallen close to $9,000 at one point last week and while this looks like a convincing bounce, it’s minor compared to the losses incurred over the last couple of weeks.

Bitcoin (Bitstamp) Daily Chart

Source – Thomson Reuters Eikon

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.