US Futures Pare Gains at Start of Busy Week

US equity markets are on course to open slightly in the red at the start of what should be another big week for the world’s largest economy.

The S&P 500 and the Dow both made decent gains again on Friday and ended at record closing highs, so the fact that we’re seeing futures pare these isn’t too surprising. Especially when you consider the week the US has ahead of it, which includes almost a quarter of S&P 500 companies reporting earnings, the Federal Reserve monetary policy decision and Friday’s jobs report, to name just a few notable events.

U.S Dollar Bulls Require a Wider Yield Spread

US Income, Spending and Inflation Data Eyed

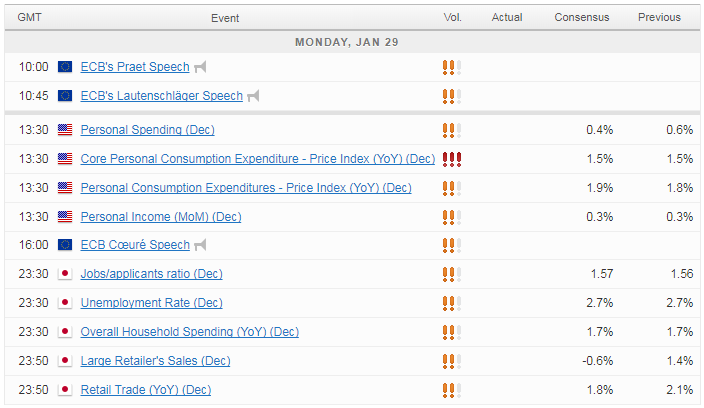

Naturally, the start of the week is looking a little quieter but even then, we’ll get inflation, income and spending figures ahead of the open which will be of interest to traders. The core PCE price index comes a couple of weeks after its CPI alternative ticked higher to 1.8%, but with this being the Fed’s preferred measure of inflation, traders will be playing close attention to it. Inflation has struggled below target for too long as with some policy makers becoming anxious about this, we may need to see evidence of it approaching target soon or interest rate hike expectations will likely be pared.

The income and spending data is also of note to traders as ultimately, improvements in both of these areas should typically feed into the end goal of 2% inflation, not to mention stronger economic growth. With the data covering December, it’s too soon for tax reform to have had a positive impact, something we should see over the course of this year. Still, we are expecting to see continued, albeit marginal, progress on both of these even in the absence of reforms.

DAX Quiet in Light Economic Start to Week

Fed and Jobs Data to Come Later in the Week

Wednesday’s Fed decision is widely being viewed as a write-off in terms of the odds of a rate hike, with it being Janet Yellen’s last meeting as Chair and following December’s increase. However, with tax reform having passed towards the end of the year, it may be interesting to see whether it has influenced policy makers views on the economy and inflation, particularly given the challenges with regards to the latter.

Friday’s jobs report will ensure traders are kept on their toes this week. As ever, focus will likely be on the earnings component given the challenges the central bank is facing, but we’ll also get figures on job creation and unemployment. Again, with tax reform having just passed, we’ll likely have to wait a little while before the impact is seen in the jobs data.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.