Are Rising Yields Weighing on Equity Markets?

It’s been another rocky start to trading in Europe on Friday and the US looks on course for a similar open, with Dow futures off around 1%.

It’s been another big week for earnings, with Apple, Amazon and Alphabet all releasing number after the close on Thursday and another 11 S&P 500 companies reporting today. At the same time, there’s been a number of important data releases this week as well as a monetary policy announcement from the Federal Reserve which has triggered another rally in US yields, with the 10-year Treasury having hit a high of 2.8%, the first time we’ve seen these levels since April 2014.

We’ve also seen corresponding rises in Europe with Gilt yields at their highest since May 2015 and Bunds at their highest since September 2015. This may well be contributing to the declines we’ve seen recently across Europe – along with the corresponding appreciation of the euro and pound – and could now be taking its toll on US stocks. That doesn’t necessarily mean we’ve entered a risk-off period or that stocks are headed for a correction but a sharp rise in yields, as we’ve seen, can also weigh on equity markets.

DAX Slips to 4-Week Lows as Deutsche Bank Shares Plunge

US Jobs Data Eyed as Fed Insists That Inflation Will Rise

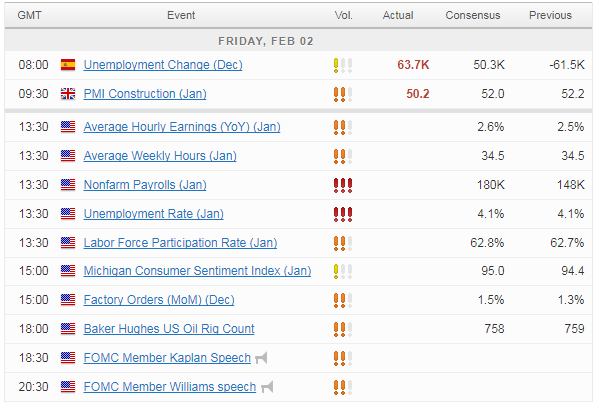

With yields now rising, all eyes will be on the US jobs report today. With the Fed anticipating higher inflation and markets buying into the idea of higher rates, the jobs data will be very closely monitored. Naturally, the non-farm payrolls and unemployment numbers will be noted, with around 180,000 new jobs expected, but it’s the earnings that people will be most interested in.

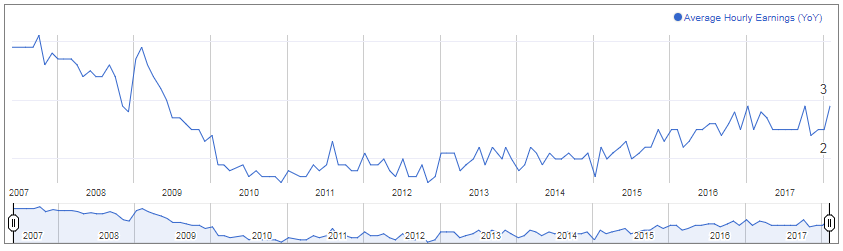

If we’re going to see a sustainable increase in inflation to 2%, wages will need to rise at a faster rate than they have for years now. The Fed has repeatedly claimed that labour market slack is deteriorating and that higher wages and inflation should follow but that is yet to materialise. Whether that’s due to slack still existing that standard measures overlook or other structural issues, it creates a problem for the central bank which is intent on continuing to raise rates. Wages are expected to have risen by 2.6% in January, up from 2.5% in December which is an improvement but not enough to satisfy the doubters.

What to look for in U.S payrolls (NFP)

Bitcoin’s Slump Continues as Losses Near 60% Since Mid-December

Bitcoin’s slump is continuing on Friday, with the cryptocurrency now trading close to $8,000 and down another 10%, with a raft of stories being blamed for its latest decline. In much the same way that every day seemed to produce another good news story for cryptocurrencies in November and early December during its ascent, we’re currently seeing the opposite in motion during its downfall with hardened regulation, outright bans, hacking and investigations being a daily occurrence.

Source – Thomson Reuters Eikon

Whether its Indian authorities cracking down on cryptocurrencies, Facebook banning adverts or the US CFTC subpoenaing Bitfinex and Tether – as suspicions grow on the relationship between the two after speculation that the latter is being created to drive the price of bitcoin higher – it seems that there’s a lot of negative news at the moment and that’s seriously taking its toll. Bitcoin is now down close to 60% from its peak and some others are faring even worse, with Ripple down around 80% in the last month following its own meteoric rise last year.

The buy the dip mentality that supported the rise of cryptos last year even through some testing times is fading by the day. We’ve seen some resilience at times over the last month and a half, most notable around $13,000 and $10,000 in bitcoin but both of these eventually gave way. In much the same way that it was difficult to pick the peak on the way up, it’s tough to pick the bottom now but based on current sentiment and momentum, it looks likely that the rout isn’t quite over yet.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.