US Futures Pare Gains as Powell Speech Triggers Another Dip in Stocks

US futures are trading slightly in the green on Wednesday, paring losses incurred on Tuesday following the hawkish testimony of new Federal Reserve Chairman Jerome Powell.

Powell’s testimony on Tuesday in front of the House Financial Services Committee was the first of two this week, with the second being in front of the Senate Banking Committee on Thursday. The new Fed Chair was very optimistic on the economy and even opened the door to upgrades to economic forecasts next month and more rate hikes which lifted the dollar and US yields, particularly on the short end of the curve.

The markets are already relatively well positioned for rate hikes, if the Fed raises as planned, but there’s still some catching up that will need to happen if four increases do materialise. The prospect of faster rate hikes in the near-term has been damaging for stock markets recently and explains why once again US indices shed more than 1% on Tuesday. This negative view of higher rates fed through to Asian and European stock markets also, both of which are comfortably in negative territory.

Fed’s Door Ajar for Four Fed hikes

Sterling Dips After Release of Draft EU Brexit Treaty

The EU released its draft Brexit treaty this morning and despite containing no language that hadn’t already been anticipated, it did weigh on the pound in the immediate aftermath, with it dropping around 40 pips against the euro and the dollar. While this isn’t too significant a move, it does highlight the ongoing sensitivity of the pound to the Brexit talks and the transition period, even when what we’re seeing and hearing isn’t new news.

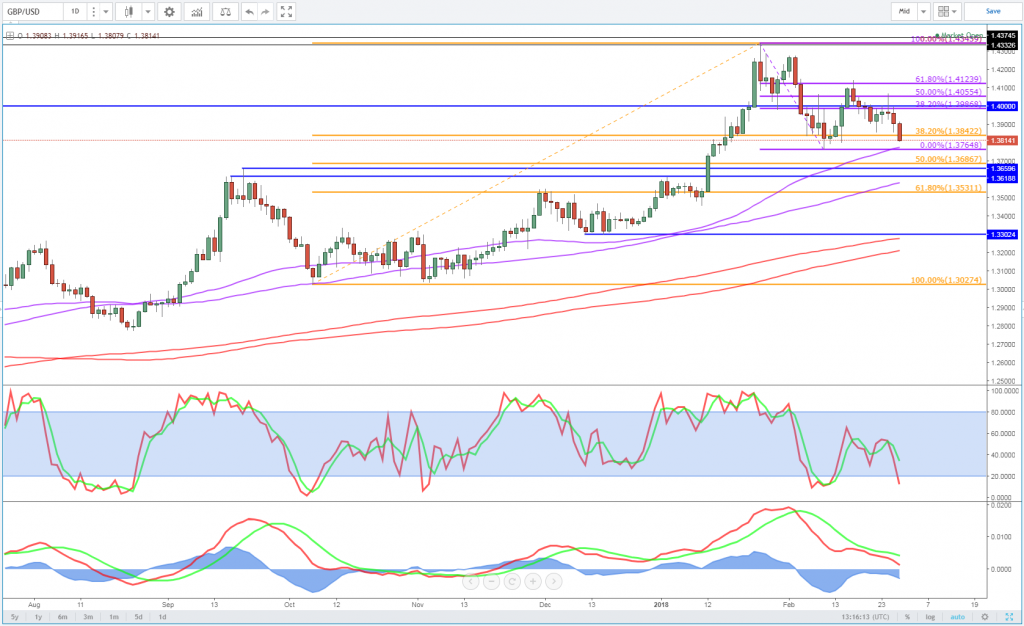

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

The pound has performed well since late last year when both sides agreed to progress to phase two of negotiations but as recent commentary – including Michel Barnier’s warnings today – indicates, some significant differences still exist and tough negotiations lie ahead. This could leave the pound vulnerable as the deadlines approach, the first of which will be that to agree on transitional arrangements.

US GDP Eyed But Attention on Tomorrow’s Testimony

Once again today there’s plenty of economic data being released that will be of interest to traders. The disappointing PMIs from China overnight didn’t help lift the sombre mood in Asian trade, with the manufacturing survey being particularly weak and falling at its sharpest rate since 2011, although this was likely driven largely by the timing of the lunar new year. Eurozone inflation eased a little in February, although this was in line with expectations and had little impact on the euro or expectations.

DAX Edges Lower after Powell Says Rate Hikes to Continue

Still to come today we have GDP data from the US – which is likely to be revised down slightly from the flash reading – as well as pending home sales, the Chicago PMI and crude inventory numbers. While all of this will be of interest, tomorrow’s appearance by Powell in front of the Senate Banking Committee will probably be more on traders’ minds today.

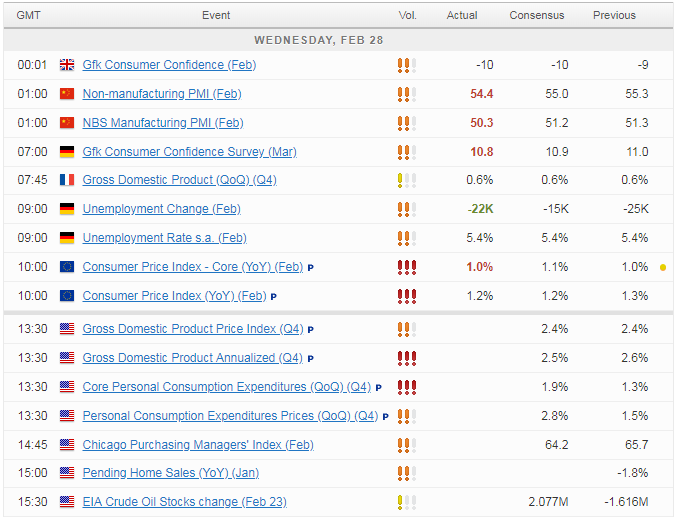

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.