Investors At Ease After Western Strikes in Syria

Stock markets have got off to a relatively positive start on Monday, despite the US, UK and France carrying out targeted strikes in Syria over the weekend in response to the chemical weapons attack a couple of weeks ago.

It was feared that a Western response could trigger an escalation in the region, further damaging relations with Russia in the process due to its backing of the Assad regime. Instead, an apparent one-off limited strike by the three countries on chemical weapons sites in an attempt to prevent further attacks in the future has not yet stoked such fears and instead, investors appear relatively at ease.

Of course, we’ll find out in the coming days just what the response to the strikes will be, assuming there will be any. For now, investors appear at ease with the situation and as long as no further escalation occurs, attention may now switch to other matters such as first quarter earnings season which got underway late last week.

Dollar Downside Risks Remain after Syria Airstrikes

US Dollar Softer as Yields Rise

We have continued to see a weakening of the US dollar at the start of the week which has coincided with higher US yields, with traders potentially seeing easing trade tensions and no significant escalation in Syria as being hawkish for interest rates. Naturally, anything that is seen as being a risk for the US economy weighs on yields so the events of the last few weeks has seen them drop from close to 3% to just above 2.7% but this is gradually improving.

This may also be being aided by Eric Rosengren’s comments on Friday when he claimed he back at least three more rate hikes this year, which is above the current consensus. Rosengren may not be a voting member this year but he is typically among the moderate hawks on the committee so it could be a view that is becoming increasingly shared, as long as some of the greater risks don’t materialise.

EUR/USD – Euro Steady to Start Week, US Retail Sales Next

Retail Sales and Manufacturing Survey Eyed

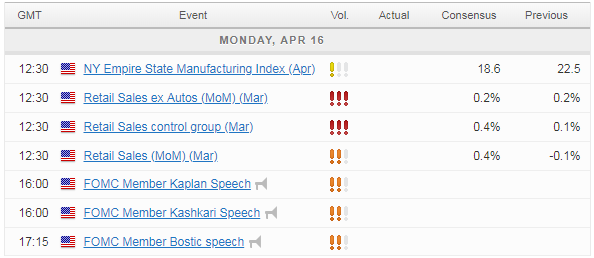

While earnings and geopolitics may be of most interest to traders this week, there are a number of data points that will attract attention. Monday can often be among the quieter days but this week we’ve got retail sales and empire state manufacturing figures which will be of interest. Retail sales have taken a dip at the start of the year but the trend remains solid and you would expect tax reforms to be supportive for spending over the course of the year.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.