Oil Gains Drive US Futures Higher

It’s been a relatively positive start to trading in Europe on Wednesday, with much of the attention falling on US President Donald Trump’s decision to withdraw from the Iran nuclear deal.

Oil is back trading at three and a half year highs this morning after Trump confirmed that the US will be withdrawing from the Iran nuclear deal and sanctions will be restored. The question now is how restrictive the sanctions will be on the Iranian economy and its ability to produce and export oil given that the UK, Germany, France, China and Russia remain committed to the deal.

Oil has been rallying for days in response to rumours that Trump would announce the withdrawal, which clearly suggests that traders believe the sanctions will further tighten global supply at a time when some of the world’s largest producers have already significantly reduced inventories. There is clearly the potential for these countries to fill the void left by the sanctions but if it aids their cause then they’ll likely opt against it.

DAX Shrugs Off Trump Bombshell on Iran Nuclear Deal

Inventory Data Eyed as Oil Rally Continues

The EIA inventory data will be of particular interest today given the attention that the oil market is already getting as a result of the sanctions. The numbers have been quite volatile for much of the year, following seven months of constant declines which brought the inventories back towards their five year average, as per the intentions of the deal between OPEC and some non-OPEC nations. The question now is how much further they’ll go to lift prices.

WTI Crude Daily Chart

OANDA fxTrade Advanced Charting Platform

US futures are currently around half a percentage point higher, with gains likely being driven by energy stocks which are leading the way in Europe currently. Brent and WTI crude are almost 3% up on the day so far which is naturally beneficial for oil and gas companies and is therefore contributing strongly to the gains. While this is providing near-term support for US indices, I wonder whether it will help in the longer-term with the US’ decision to pull out potentially increasing geopolitical risk.

U.S Dollar Rises on Higher Yields, EM pairs suffer

This comes at a time when stock markets already look quite vulnerable having failed to recover in any significant way from their lows. Despite the occasion positive days, the momentum looks very much with the bears right now and a break below this year’s lows – which have been tested a few times now – could trigger further sell-offs.

Dow Daily Chart

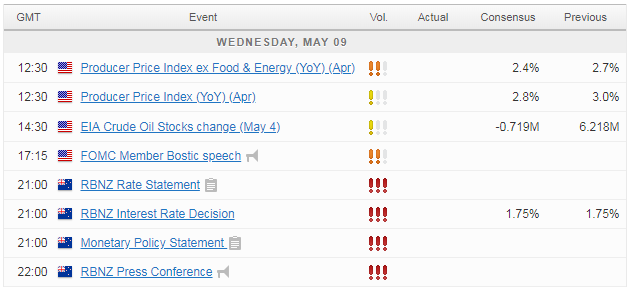

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.