US Equities Looking Less Vulnerable After Recent Breakouts

US equity markets have been on a good run of late but are poised to open slightly lower on Tuesday, paring the steady gains achieved over the last couple of weeks.

This comes after the Dow and S&P 500 both surpassed the previous peak which came almost a month earlier in what could be a symbolic indication that the worst of this particular correction is now behind us. From a technical standpoint, the failure to make a new low a couple of weeks ago before now making a new high is encouraging as a signals the end of a downtrend.

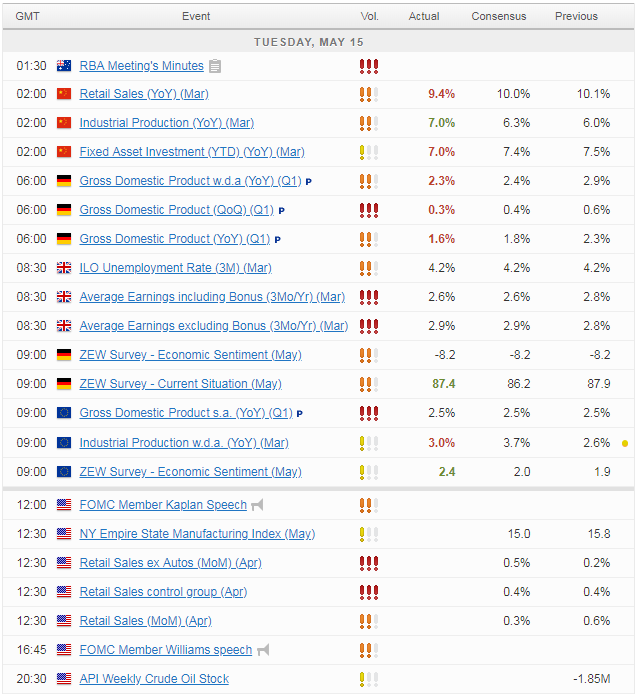

Retail Sales Expected to Rebound After Tough Winter

There’s a number of data releases that will grab traders’ attention today and could determine whether we see an early rebound in stock markets. The most notable of these is the retail sales data for April, which is expected to be relatively good for a second consecutive months following a few poor numbers that were a little worrying. Core retail sales are also expected to be good, rising by 0.5% compared to March.

Rate Differentials and Trade Fears Handcuff Capital Markets

UK Jobs Data in Line as Wages Rise Most Since 2015

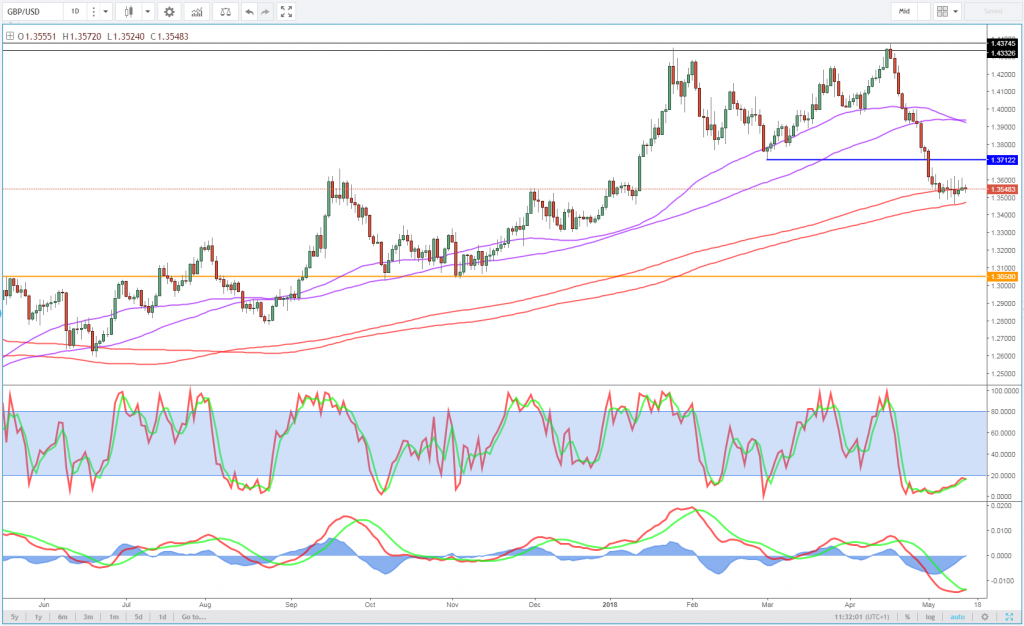

The UK labour market figures offered little support to the struggling pound this morning, which continued to hover around four month lows against the dollar and look vulnerable to further declines. While unemployment remains at the lowest since 1975 and employment at the highest since records began, the numbers were all pretty much in line with expectations and was therefore priced in.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

The potential for upside would have likely come from the earnings data but even this was in line, although excluding bonuses, they did rise to 2.9% which is the highest since August 2015. Still, with inflation still high, real wages were unchanged once bonuses were taken into consideration which is likely to continue to weigh on the economy and confuse matters for the Bank of England, which is being heavily criticised after not raising rates last week.

Clearly traders don’t view the increase in wages as increasing the chances of a rate hike from current expectations. It could well be that traders view the recent wage data as being a temporary response to last year’s increase in the cost of living due to higher inflation as opposed to something more sustainable or that the recent improvement is being flattered by the year on year comparison after a dip 12 months ago.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.