Markets Remain Buoyed By Potential Progress in Italy

US futures are trading flat ahead of the open on Thursday, with Europe mostly a little higher as negotiations continue to avoid another election in Italy.

Not too long ago, a coalition government in Italy consisting of two eurosceptic populist parties was a feared and unlikely prospect that many believed would majorly concern investors. While much of this remains true, it is also currently viewed as the least unattractive and feasible outcome for markets, with the other alternative being fresh elections and the possibility that the parties are given an even stronger and potentially less euro-friendly mandate.

Italy’s President, Sergio Mattarella, may have believed he was acting in the best interest of the country when he rejected to populists choice of Finance Minister but the reality is that in doing so, he has given both parties more ammunition with which to attack the euro. Mattarella has already been accused of acting on behalf of Germany and others while Brussels has been accused of interference, it all feeds very well into the eurosceptics message that the country no longer even has control over its domestic politics.

Should the country move straight on to another election, both Five Star Movement and Lega will look to take advantage of any fury linked to perceived meddling and could significantly add to their numbers. All of a sudden, the worst case scenario prior to the election looks tolerable compared to what could come from another. With both parties now in discussions again, there is a hope that the political impasse can be resolved which is helping to lift sentiment in the near-term. That said, a positive outcome now poses many further risks in the long-term.

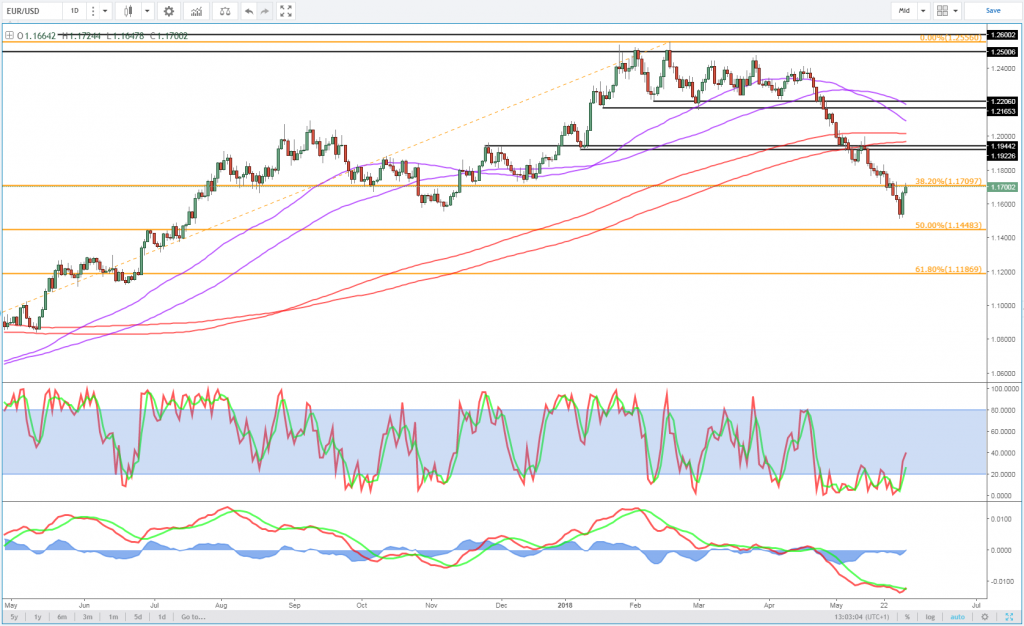

EUR/USD – Euro Edges Higher on Strong Eurozone CPI

Euro Rebounds on Prospect of No Second Election

While Italian assets have bore the brunt of the pain from the latest period of political instability and uncertainty, there has been a negative impact on the wider markets including the euro which dropped to a 10-month low against the dollar. While we’re still far away from the days of the debt crisis and the risk of a breakup, a second election was being portrayed as a vote on the euro which seems drastic and probably overhyped but it certainly hit the single currency.

EURUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

We’ve seen the euro bounce back over the last 24 hours although it has come off its highs this morning in response to the higher than expected unemployment reading. Interestingly, inflation did come in above expectations at 1.9% overall and 1.1% on a core basis although this appears to have been largely shrugged off.

As Risk Sentiment Improves Dollar Bulls Sell

Plenty of US Data on the Agenda

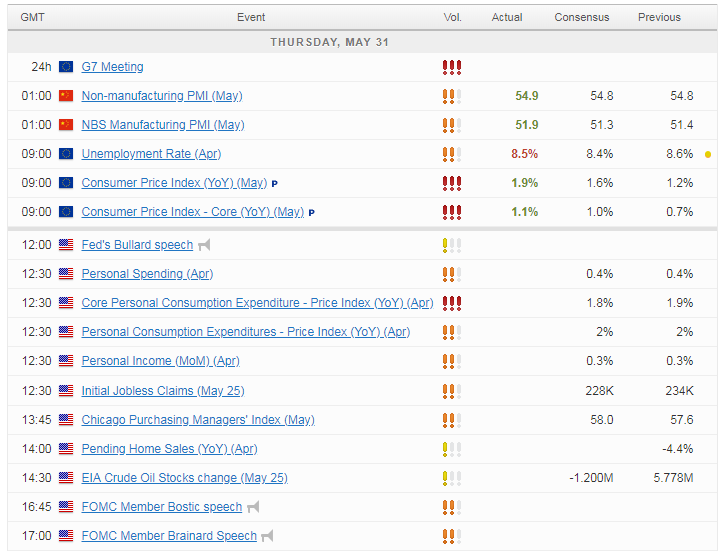

There’s plenty more data to come today with inflation, income, spending, jobless claims, pending home sales and the Chicago PMI due from the US. We’ll also hear from some Federal Reserve policy makers – James Bullard, Lael Brainard and Robert Kaplan – which will be of interest ahead of the meeting in two weeks, at which the central bank is widely expected to raise interest rates for the second time this year.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.