Additional tariffs trigger more risk aversion

US markets are on course for another day in the red as we await the open on Tuesday, with futures down more than one percent as US President Donald Trump threatens to intensify the trade spat with China.

Trump has requested that another $200 billion of Chinese goods be identified for a 10% tariff as he ramps up the pressure on China to address the trade imbalances between the world’s two largest economies and stop other practices the President deems unfair. Trump has already pre-empted a response by China and claimed that any retaliation will be met with another $200 billion list being drawn up which suggests he has no intention of backing off, no matter what the consequences.

With China showing no desire to be bullied into submission, with its Commerce Ministry promising to retaliate to any new tariffs and its Foreign Ministry reaffirming that while it doesn’t want a trade war, it’s not afraid to engage in one, it’s difficult to see how and when this ends. Moreover, it’s difficult to fully grasp just how much damage will be done in the process, particularly with the European Union also drawing up counter-tariffs against the US.

Risk off moves supported by tit-for-tat trade dispute

The clear escalation that’s occurred in recent days has shaken investors and appears to brought an end to the good run that US stock markets had been on since the start of May. While Chinese stocks are faring much worse at the moment, US companies are obviously not immune to a trade war and could come under more pressure unless both sides find a solution.

Gold not benefiting from safe haven moves as dollar weighs

We’re seeing plenty of risk aversion in the markets in response to the tariffs although interestingly Gold is not seeing the usual safe haven gains as a stronger dollar is weighing on demand for the yellow metal. The dollar appears to be benefiting from a combination of safe haven Treasury demand which has driven the 10-year yield back below 2.9% and weakness in the euro and the pound.

EUR/USD – Euro slips as trade war worsens

EUR and GBP continue slide ahead of central bank speeches

The euro is still suffering from the ECBs successful attempts to wrap a hawkish policy move in dovish rhetoric last Thursday which has pushed the single currency back towards 1.15 which has been a notable support level over the last 10 months. Sterling on the other hand appears to be suffering ahead of the Bank of England meeting on Thursday, with Brexit-related uncertainty hanging over Prime Minister Theresa May ahead of some crucial talks with the EU this month.

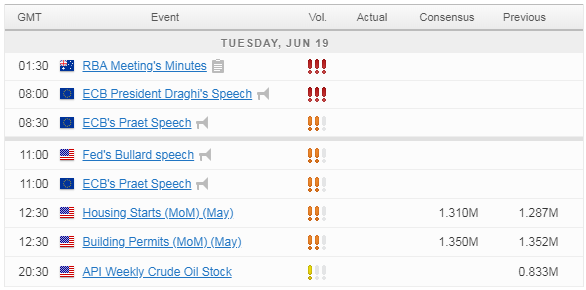

While the data calendar looks a little bare today, with US building permits and housing starts the only notable releases, we are preparing for remarks from a number of prominent central bankers over the next couple of days that could have a significant market impact. We heard from Mario Draghi earlier in the European session but the ECB President offered little more than a rehash of earlier statements.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.