Trump threatens more tariffs and bans on Chinese ownership

A new week is underway and yet the same concerns remain as Donald Trump ramps up trade threats against China and the EU which continues to take its toll on risk appetite.

Investors may be feeling very uneasy about the approach being taken by the US President, but Trump is showing no sign of shying away from a trade war, instead threatening more tariffs on those that retaliate to those already imposed. It’s very much the relaxed manner in which Trump and others appear willing to allow this to escalate that makes investors so nervous.

The latest measures are set to focus on technology transfers, with Trump apparently preparing to stop some Chinese companies investing in US tech firms while also blocking tech exports to China. This comes as he has also requested an extra $200 billion of tariffs to be identified in response to China’s own counter-measures.

The EU is also being targeted by Trump, with the President threatening tariffs on auto imports if it pushes ahead with its own counter-measures. Needless to say, neither side is looking like backing down on this and in the near-term, it’s the companies that are suffering as is clearly evident with European automakers today.

Oil pares Friday’s gains as producers agree to increase output

Trade aside it’s been a relatively quiet start to the week. Oil is paring Friday’s gains at the start of the week which came as oil producers agreed to increase output now that global inventories have fallen back towards their five year average.

While this is good news for consumers, much of this had already been priced in and there were questions about how much they would actually be able to increase output, especially in the near term, with some suggesting it would only increase by around 600,000 barrels per day, well short of the one million number that was reported.

China’s liquidity boost tempered by trade war jousting

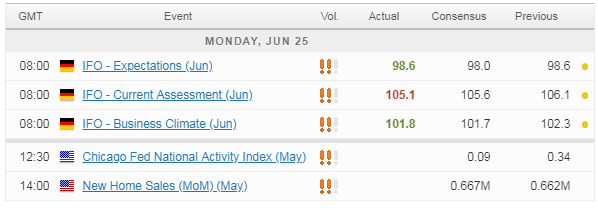

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.