Markets higher after tariff-related losses

It’s been a more positive start to trade on Thursday, with equity markets in the green and paring Wednesday’s losses as investors continue to weigh up what impact the latest trade tariffs will have on the global economy.

While markets have typically reacted negatively to any escalation on trade, the overall impact has been relatively modest under the circumstances which suggests investors are far from panic mode right now. Many agree that tariffs will ultimately be bad for the global economy and therefore markets but there still seems to be some hope that common sense will prevail and a full blown trade war will be averted.

With Donald Trump now pursuing another $200 billion in tariffs against China though, we may have to wait a while as he is not easing up and China – and others – is determined to prove it will not be bullied into submission. Perhaps if the economy starts to suffer or the Republicans do badly in the midterms in November Trump will be forced to consider an alternative approach.

Equities shrug off trade tariff tensions

US inflation seen rising further

As it stands though, the economy is doing very well – aided by last year’s tax reforms – and the Federal Reserve is on course to raise interest rates twice more this year, having increased them on two occasions already. The central bank is clearly more concerned about the economy overheating right now than the prospect of a trade war – although this is also on their radar – and the inflation data we’ve seen very much justifies their view.

While CPI is not the Fed’s preferred measure of inflation, it does provide valuable insight and is typically released a couple of weeks before the core PCE price index. Today’s release is expected to show prices rising by 2.9% in June compared to a year earlier, with core inflation having risen by 2.3%, above the Fed’s 2% target. The core PCE price index may be a little behind this at 2% but this is at target and on the rise. Any unexpected increase today may suggest a similar rise is on the cards for the PCE numbers as well.

(Update 1) A tenuous and unstable state of affairs

ECB minutes eyed after dovish tightening last month

The minutes from the most recent European Central Bank meeting will also be released today. The ECB confirmed at the last meeting that it will end its quantitative easing program at the end of the year and won’t raise interest rates until at least the middle of 2019, which was largely in line with expectations. The dovish spin that was put on it though weighed on the euro at the time and it will be interesting to see whether the minutes have a similar impact.

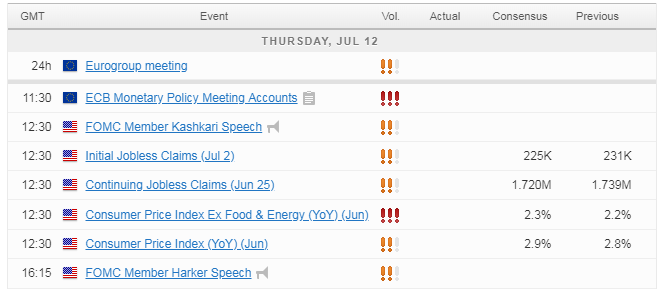

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.