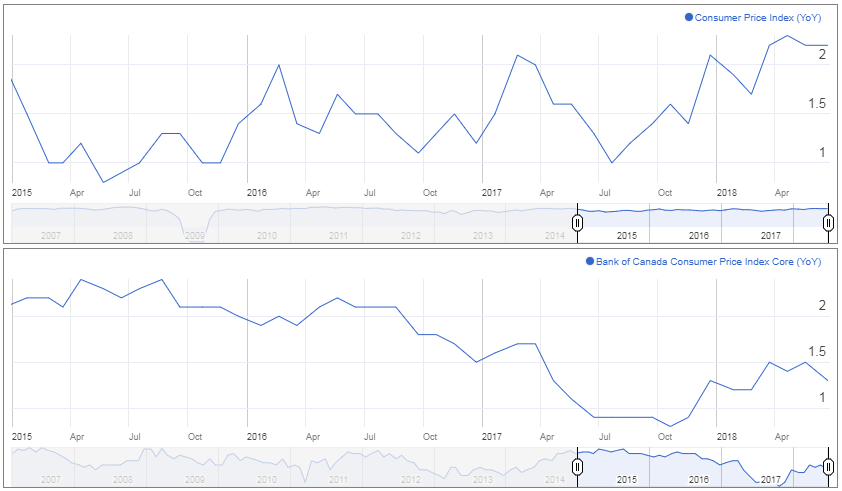

Canadian inflation data eyed as BoC ponders more hikes

It’s looking like being a quiet end to the trading week, with the only notable economic releases coming from Canada and it being one of the less eventful days of earnings season.

The Canadian inflation figures will be one interesting takeaway today, after a year in which the central bank has been actively raising interest rates, most recently this month taking the number of hikes to four. The Bank of Canada has been extremely aggressive so early in the tightening cycle having last raised rates prior to this in 2010, especially when you consider that the economy is not exactly firing on all fronts like the US.

Canadian Inflation

Still, inflation is clearly a concern of the BoC with the headline number having surpassed 2% again recently, so traders will be paying close attention to today’s numbers. Markets are pricing in a good chance of another rate hike this year and today’s numbers, should they meet expectations, could further support this view. While the dollar continues to make loonie, others including the pound and yen haven’t been so fortunate, with the BoC seen as being more active going forward despite the threat posed by NAFTA negotiations.

DAX trading sideways as investors look for cues

USD weaker as Trump weighs in on Fed monetary policy

The dollar is taking a bit of a breather today, coming on the back of losses on Thursday afternoon as US President Donald Trump took the unusual decision to weigh in on the Federal Reserve’s interest rate policy. President’s don’t tend to give a view on monetary policy in much the same way that policy makers will shy away from expressing political views as it infringes on the independence of the central bank.

US Dollar Index Daily Chart

Source – Thomson Reuters Eikon

That said, Trump is not known for going along with the acceptable norms so it’s hardly surprising that he’s weighed in, especially as he tries to deflect attention away from his role in much of what he was complaining about. It’s quite clear to most people that part of the reason for the Fed raising rates at the current pace is the tax reform measures passed at the end of last year, when the economy was already running hot.

Yuan’s fall extends to a fourth straight day

Independent Fed unlikely to be influenced by Trump views

This is also partially responsible for the dollar rising against other currencies, particularly the yuan and euro, which has suffered further as the President has sought to start a trade war with both. Trump is not one to accept responsibility for such events and now appears to be actively trying to push the blame onto others in a clear attempt to halt the rise in the greenback, the strengthening of which could weigh on the economy and soften the impact of the trade measures he is taking against other countries.

The worry is that he may try to put pressure on policy makers to slow the pace of tightening, which could be a major risk for the economy in the longer run, or explore other alternatives to influence the central bank, even if he has only recently personally selected the Chairman, Jerome Powell. Naturally, the White House attempted to downplay Trump’s comments after the event but the damage was done and Trump’s views on these matters are clear, even if they are somewhat misleading or misguided. Ultimately, I don’t expect the Fed to be influenced but that doesn’t mean Trump won’t find an alternative way to deal with the issues, even if such solutions are controversial and prove ineffective or self-defeating.

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.