Markets buoyed by easing trade war risks

European markets are trading in the green once again on Friday, with futures pointing to a similar open in the US, as an apparent easing in trade tensions between the US and European Union boosts risk appetite.

While only the outline of an agreement on trade between the two – which account for more than half of global GDP – was released, it was widely viewed as an important first step towards more cooperation and closer ties, and away from protectionism. For Donald Trump, the concessions offered by the EU represent an important victory at home ahead of the midterm elections – although the real benefits of them may not be known for some time.

Juncker on the other hand will be a relieved man, returning to Europe having avoided tariffs being imposed on the auto industry and with apparent assurances both sides will work towards removing those already imposed, while lowering other tariffs and non-trade barriers in the future. This was also ultimately the goal of Trump as well when imposing the tariffs so both will feel they have come out of this better off.

U.S dollar firmer on GDP expectations

Strong week of earnings despite Facebook horror show

Ultimately, the biggest winner here may be investors as the meeting now potentially sets a precedent for how other trade conflicts can be resolved, although the feud with Beijing is more complex and may take much longer to repair. The protectionist measures adopted by Trump as a tool to fight other countries on trade – and then by those countries in retaliation – have weighed on markets since the start of the year, keeping the S&P 500 and Dow off their highs despite companies having reported huge earnings growth – primarily driven by tax cuts – in the first two quarters.

It’s been a big week for earnings season, with a third of S&P 500 and Dow companies reporting on the second quarter. While the general trend has remained, with companies reporting strong figures, it hasn’t passed without its casualties, with Facebook closing almost 20% lower yesterday after reporting disappointing numbers and forecasts. Today is looking a little quieter on the earnings front, although there are still 18 S&P 500 companies reporting, including Exxon Mobil and Twitter.

US GDP eyed as Trump hopes for more than 4%

On the data side, the US will release GDP figures for what is expected to be a bumper second quarter after a modest first few months of the year. The economy is expected to have grown 4.1% on an annualised basis, which will naturally be championed by Trump as being rewards for his hard work. It will be interesting to see how markets react, should the economy outperform expectations, with the Federal Reserve already on course to raise rates twice more this year.

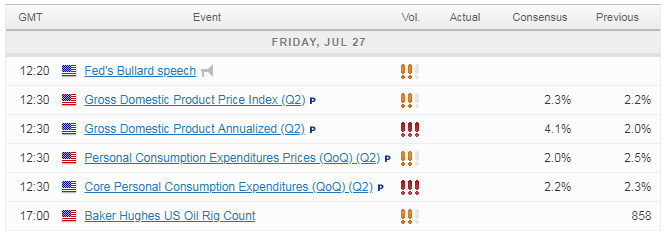

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.