Thursday August 23: Five things the markets are talking about

The U.S dollar has rallied for the first time in six-sessions as the markets waits for rhetoric from Jackson Hole where a meeting of global central bankers begins this evening.

Yesterday, the Federal Reserve signalled a ‘no change’ to its pace of monetary policy tightening, allowing the greenback to climb against most of its peers.

U.S Treasuries are steady after the Fed indicated they are prepared to increase rates again if the economy stays on track. Yesterday, the Fed minutes point to another interest-rate increase next month.

“Many participants suggested that if incoming data continued to support their current economic outlook, it would likely soon be appropriate to take another step in removing policy accommodation,” according to the minutes. Most officials signalled they are keen to raise rates to a level that “neither spurs nor slows growth,” – the so-called “neutral rate.”

Alongside Trump’s legal woes, the market is also trying to gage the imposition of new tariffs between the U.S and China in the midst of talks aimed at averting the worsening trade conflict.

On tap: Jackson Hole symposium begins.

1. Political woes pressure stocks

Global equities traded mixed overnight amid speculation U.S President Trump’s political position could be threatened by his current legal woes and as fresh Sino-U.S tariffs took effect.

In Japan, the Nikkei edged a tad higher after a weak yen (¥110.89) supported sentiment, however, German profit warnings dragged down auto stocks and tire makers. The Nikkei share average ended +0.2% higher, while the broader Topix was unchanged.

Down-under, Aussie shares fell overnight, as uncertainty over whom the country’s next PM would be distressed investor confidence, with losses in financials capping gains in resources stocks. The S&P ASX 200 index lost -0.3%. In S. Korea, the Kospi stock index advanced +0.4% overnight, even though fresh U.S-China tariffs weighed on the market.

In China, stock markets ended higher, as investors mostly looked past new U.S and Chinese tariffs that mark the latest escalation of the trade war between the world’s two largest economies. The Shanghai Composite index ended +0.4% higher, while the country’s blue-chip index gained +0.3%.

In Europe, regional bourses trade slightly higher in quiet trade with trade tensions and mixed European PMI’s figures (see below) capping gains.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 0.2% at 385.1, FTSE 0.3% at 7591, DAX +0.1% at 12391, CAC-40 +0.3% at 5435, IBEX-35 +0.4% at 9617, FTSE MIB +0.1% at 20714, SMI +0.2% at 9066 S&P 500 Futures +0.1%

2. Oil slips on tariffs

Oil prices have slipped as the U.S-China trade dispute outweighs the bullish impact of a decline in U.S crude inventories.

Brent crude oil is down -30c a barrel at +$74.48, while U.S light is -10c lower at $+67.76.

Note: The trade dispute between the world’s two largest economies has deepened today with the imposition of another +25% tariffs on +$16B worth of each other’s goods.

Bullish for crude was yesterdays data from the EIA which showed that U.S commercial crude oil inventories fell by -5.8M barrels in the week to Aug. 17 to +408.36M barrels.

Ahead of the U.S open, gold prices are under pressure, falling from their one-week high from yesterday, as intensifying Sino-U.S trade war with another round of tariffs and expectations of higher interest rates support the dollar. Spot gold is down -0.6% at +$1,188.16 an ounce. U.S gold futures are down -0.7% at +$1,194.80.

3. Sovereign yields ease

The Tsy-Bund spread is at +247 bps – the tightest in two-months as the eurozone economy and inflation shows signs of improvement and the market questions how long the U.S. economic strength will last. There is no supply in the eurozone today and the 10-year Bund yield is trading at +0.35%, down -1 bps. Other eurozone bond yields are mostly unchanged, except Italian bonds – the 10-year BTP yield has declined -4 bps to +3.026%.

Elsewhere, the yield on U.S 10-year Treasuries has decreased -1 bps to +2.81%, the lowest in more than three-months. In the U.K, the 10-year Gilt yield has dipped -1 bps to +1.272%.

4. Dollar finds support

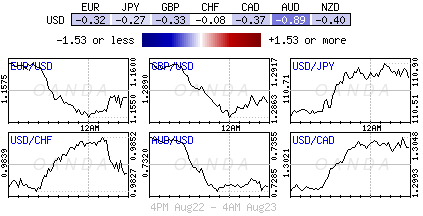

The USD is a tad firmer overnight, breaking a six-day losing streak aided by yesterday’s Fed minutes that signalled another rate rise is coming. Market concerns over the Sino-US trade negotiation is again a pressing issue now that the U.S has implemented another round of tariffs.

EUR/USD (€1.1565) is lower by -0.2%, pressured by mixed Euro manufacturing PMI data.

GBP/USD (£1.2868) is a tad softer as Brexit negotiations continue and the AUD/USD was back below the psychological A$0.73 at A$0.7294 after Australia adjourned its parliament until Sept 10th amid a political leadership crisis. PM Turnbull is seen as unlikely to contest another leadership vote.

Among the biggest currency losers overnight is South Africa’s rand ($14.2920), which slumped after a tweet from U.S President Donald Trump fuelled speculation of possible sanctions against the country.

5. Euro PMI’s signal steady expansion

Flash PMI survey data this morning indicated that the eurozone economy continued to grow this month, albeit with the rate of expansion remaining one of the weakest seen over the past 18-months, while companies’ expectations of future growth slipped to the lowest for nearly two years.

The IHS Markit Eurozone Composite (manufacturing and services) PMI edged a tad higher from 54.3 in July to 54.4 in August.

Digging deeper, the rise signalled a marginal acceleration of output growth during the month. However, the increase in output was the third weakest since January 2017. New order growth picked up marginally, but, was the third weakest since December 2016. A particularly sluggish performance was seen in manufacturing, where new export orders registered the smallest monthly rise for two-years.

Although growth rates improved slightly in manufacturing and services, both remained among the weakest seen for at least 18-months.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.