Wednesday August 29: Five things the markets are talking about

For now, trade negotiations remain the dominant theme for market moves as uncertainty over how Canada will respond to Monday’s ‘non-ratified’ agreement between the U.S and Mexico.

U.S-Canada talks are underway and a failure for Canada to agree over the new bilateral terms that have been agreed upon between the other two former Nafta members could mean tariffs going up on exports such as automobiles. However, there are reports that Canada is ready to make concessions on its dairy market to be included in any North American trade deal.

For the U.S, time constraints are an issue, with the U.S midterms in November; there is a 90-day period for Congress to be consulted on any decision to disband NAFTA.

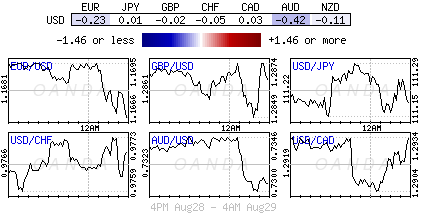

Some European bourses and U.S futures are trading in the green after a lackluster Asian session. G10 currency pairs are again confined to a relatively tight trading range. The EUR has lost some of its lustre after the Italian government was said to be asking the ECB to pass a new program of bond purchases to protect the third largest European economy its debts.

On tap: The U.S economy is expected to have grown in Q2, but at a slightly slower pace. Preliminary GDP is released at 08:30 am.

1. Stocks mixed results

In Japan, the Nikkei rallied overnight for the seventh consecutive session as tech stocks advanced along with their counterparts stateside. The Nikkei ended the day up +0.15%, while the broader Topix rallied +0.46%.

Down-under, Aussie shares rallied, supported mostly by the financials and the tech sector. The S&P/ASX 200 index rose +0.8% at the close. The benchmark added +0.6% on Tuesday. In S. Korea, the Kospi stock index rose +0.26% on positive sentiment about the U.S-Mexico trade deal, but concerns over the Sino-U.S tariff war capped gains.

In Hong Kong, stocks rallied overnight, supported by property developers, but concerns for trade and economic growth in China put pressure on the Hang Seng’s China Enterprises index. At close of trade, the index was up +0.23%, while the Hang Seng China Enterprises index fell -0.13%.

In China, stocks fell, as the country’s state planner warned of more risks to growth in H2 of 2018. The blue-chip CSI300 index fell -0.4%, while the Shanghai Composite Index ended down -0.3%.

In Europe, regional bourses trade mixed in another quiet day ahead of the long weekend stateside. FTSE (-0.3%) is under pressure as miners weigh on the top-flight index in response to strength in the ‘big’ dollar.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx600 +0.1% at 385.4, FTSE -0.3% 7593, DAX 0.0% at 12524, CAC-40 0.0% at 5484, IBEX-35 -0.7% at 9538, FTSE MIB -0.4% at 20554, SMI -0.3% at 9059, S&P 500 Futures +0.1%

2. Oil slips on rising U.S supply, Venezuela investment

Oil prices are under pressure, pulled down by a rise in U.S inventories and hopes that new investment could halt a plunge in Venezuela’s output.

Brent crude oil is down -20c at +$75.75 a barrel, while U.S light crude -10c lower at +$68.43 a barrel.

There are reports of potential investment in Venezuela’s struggling oil production is also affecting markets.

Note: Venezuelan crude exports have been reduced by -50% in 24-months to below +1M bpd.

API data yesterday showed that U.S crude inventories rose by +38K barrels to +405.7M barrels in the week to Aug. 24. The market had been expecting a headline drawdown.

Expect dealers to take their cue from today’s official U.S fuel inventory data by the Energy Information Administration (EIA) – released at 10:30 am EDT.

Ahead of the U.S open, gold prices have inched a tad higher after yesterday’s sharp fall, but a firmer U.S dollar, supported by higher rates and lingering Sino-U.S trade tensions seems to be capping the ‘yellow’ metals gain. Spot gold is up +0.3% at +$1,204.43 an ounce, while U.S gold futures are down -0.3% at +$1,210.60.

3. BTP yields fall on report that Italy may ask ECB for more QE

Italian bond yields have fallen -4 to -5 bps ahead of the U.S open, on reports that Italy may reach out to the ECB for help.

According to local sources, the Italian government plans to reach out to the ECB for a new round of QE to avoid a ratings downgrade.

Note: Italy has been searching for allies to support its bonds in recent weeks, with the U.S and China voicing concern about a recent widening in Italy’s bond yield spread over euro zone peers.

Italian 2-year BTP yields are down -5 bps at +1.24%, while its 10-year BTP yield fell -3 bps to +3.15%, narrowing the gap over German Bund yields to +277 bps from yesterday’s +280 bps.

Elsewhere, the yield on U.S 10-year notes declined -1 bps to +2.87%. In Germany, the 10-year Bund yield was unchanged at +0.38%, the highest in three-weeks, while the U.K’s 10-year Gilt yield declined -1 bps to +1.449%, the largest fall in more than a week.

4. Dollar shines for now

EUR/USD (€1.1670) has moved back below the €1.17 handle as concerns on Italy continued to simmer. The EUR’s move higher over the past fortnight (€1.13 to €1.17) removed all the pricing of political and economic risks from Turkey and the rest of emerging markets. However, the situation in Turkey has not changed – TRY continues to fall €7.4320 – but it seems the market has taken the view that European banks do not have too much debt exposure to Turkey. The EUR is also on firmer footing because the big dollar has not found that “safe haven” support on global trade worries.

GBP/USD (£1.2888) is steady but holding below the psychological £1.29 level despite U.K and EU officials now saw mid-November as the new Brexit deal deadline rather than Oct.

Note: delays could present timetable challenges to ratifying the Brexit terms by Mar 29th 2019

Elsewhere, the CAD (C$1.2920) advanced after a report indicated that PM Trudeau is ready to make concessions on its dairy market to be included in any North American trade deal.

5. French consumer spending growth slowed in July

Data this morning showed that growth in French consumer spending slowed last month, but by less than expected, as households spent more on food and clothing.

According to Insee (French statistics agency) consumer spending rose just +0.1% on month after revised figures showed a +0.3% increase in June. The market was expecting a headline print of a month-to-month decrease of -0.2% in July.

Digging deeper, energy spending declined -0.2% on month primarily because of a drop in gasoline purchases, while household durable goods fell -0.8%, with a drop in TV purchases after the end of the soccer World Cup. But those declines were offset by a +0.2% on-month increase in food spending, as well as a +0.4% rise in clothing.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.