The hurricane season is approaching and is already having and impact on oil prices. The metals sector continues to struggle, apart from palladium, in the face of tariff war worries. The agricultural sector is attempting a rebound, mostly as supply-side issues influence.

Energy

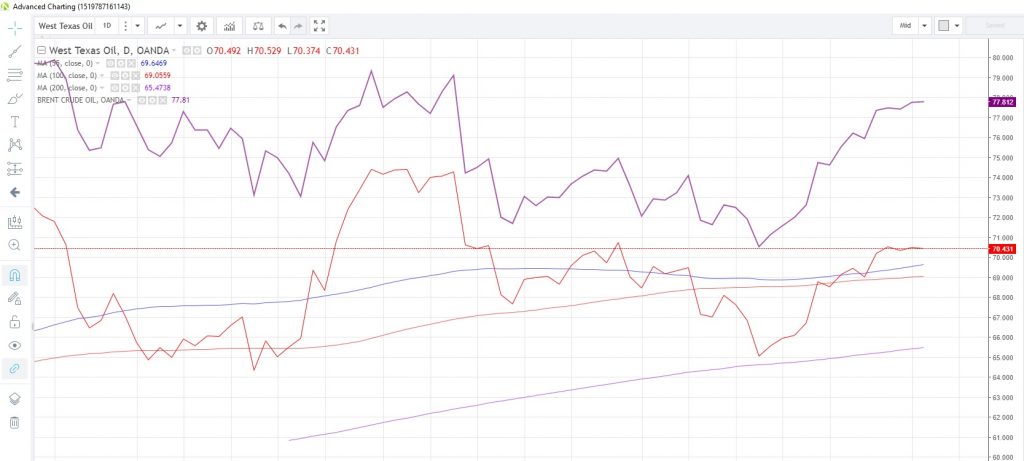

CRUDE OIL is trading higher, with West Texas Intermediate consolidating above $70 per barrel as tropical storm Gordon threatens production on some Gulf of Mexico oil platforms. Two platforms have already been evacuated, with the possibility of more to come as Gordon traverses the Gulf. WTI has held above $70 for the last four sessions, also helped by the supply issues linked to the pending Iran sanctions, which are due to fully kick in from November. WTI is currently trading at $70.431 with prices still capped by the 100-month moving average at $74.4697.

The spread with Brent crude has widened further to 7.4 pips, the widest since June 20, with Brent now trading at $77.812 per barrel.

WTI/Brent Spread Chart

Thursday’s release of EIA stockpiles data (delayed a day due to yesterday’s US holiday) is expected to show a further drawdown, this time of 4.2 million barrels, adding on to last week’s 2.6 million. That would be the third consecutive weekly drawdown of inventories.

NATURAL GAS continues to hover below the $3.0 mark despite steady demand for cooling as US temperatures remain high. The commodity has traded below the 55-month moving average, which is currently at 2.9799, for the past seven months and that looks set to continue this month.

Russia’s supply on natural gas to Europe rebounded strongly in August after pipeline maintenance affected supplies in July. China’s PetroChina has said it intends to increase domestic production of natural gas by 4-5% over the next five years, though it states that this would still not be enough to satisfy demand increases and China will still be heavily reliant on crude oil and natural gas imports.

EIA stockpile data as at August 24 showed stockpiles were 19% below the five-year average and 21% below the levels a year ago, Bloomberg reports. Storage data due Thursday is expected to show stocks at 50 billion cubic meters from 70 billion a week ago.

Precious metals

The temporary weaker bias for the dollar seen over the last two weeks helped GOLD recover the 1,200 handle last week, but since the dollar’s slide appears to be halting, so the 1,200 level seems to be shaky again. Gold fell as much as 5.2% last month, the fifth consecutive monthly loss, and touched a 19-month low of 1,160.20. The metal is currently at 1,201.36.

The rebound in gold’s fortunes saw a scaling back of speculative net short positions, according to CFTC data as at August 28. Net shorts stood at 3,063 contracts, down from 8,710 the previous week.

Speculative traders were more convinced about shorting SILVER, where net short positions increased by 9,440 contracts to 16,598, the largest net short position since the week of April 3, CFTC data shows. Silver remains capped by the 55-month moving average, sitting at 16.8198, and has only fleetingly traded above it since April 2013. Silver is currently at 14.4847, holding just above the August 16 low of 14.3375, which in turn was the lowest since February 2016.

PALLADIUM confounded all other precious metal last month. While, gold, silver and platinum all fell, palladium jumped 18.5% from low to high, to record the first up month in three. The US-Mexico trade deal could bode well for the car industry and prompt higher demand for palladium for use in catalytic converters.

The metal broke through the 55- and 100-day moving averages with ease and is now testing the 200-day moving average at 990.0859, which has held since June 18. Palladium is now at 981.234.

Palladium Daily Chart

PLATINUM has had a steady start to September, licking its wounds after the third consecutive monthly loss in August. Speculative net short positions remain near record levels with only a reduction of 16 contracts to net shorts in the week to August 18, as evidenced by the latest CFTC data. Prices are currently at 788.947

Base metals

COPPER is also trading at the mercy of the US dollar. Weakness in the past two weeks helped the industrial metal rebound from 14-month lows but the bounce appears to be struggling, failing to reach the 55-day moving average at 2.7648. Ongoing concerns that an escalation in the US-China tariff wars could come as soon as Thursday this week are capping any gains. The metal is currently at 2.6283.

Agriculturals

WHEAT prices continue to be influenced by supply/demand headlines. The Russian story on possible export restrictions, that first did the rounds two weeks ago, resurfaced again late last week with the Russian Agriculture Ministry saying it will probably introduce restrictions around December to withhold Russian wheat from global sale, assuming the current pace of sales. Russia’s wheat exports hit a record in August, official sources said. Meanwhile, Australia’s drought situation and quality issues from Russia and Ukraine are all combining to lift wheat prices moderately. Wheat is currently trading at 5.119.

Brazil’s exports of SOYBEANS rose 36.5% y/y to 8.1 million tons in August, a record for the month, according to official data. Meanwhile, Argentinian farmers are protesting the imposing of additional export taxes on crop exports, including soybeans. In addition to the 14% existing tax, farmers must now add on an extra four pesos for each dollar-worth of exports as the country battles rampant inflation, high interest rates and a plunging currency. The all-in tax is now expected to amount to about 28.5%. Soybean prices are holding near the multi-year low of 8.082 and seem to be struggling to gain any traction.

CORN exports from Brazil tumbled in August, dropping 45% from a year earlier, according to official statistics. On Friday, ahead of the long US weekend, corn had its biggest one-day rally since July 6, rising 2.8% to close at 3.484. The commodity is currently testing the 55-day moving average at 3.4974 and, should it be breached on a sustained basis, could head toward the 200-day moving average and August 17 high at 3.6051 and 3.6380, respectively.

SUGAR is attempting a bounce from the August low, though both technical and fundamental hurdles still have to be overcome. Brazil has announced that it is to approach the WTO about China duties on sugar imports. It suggests that, all-in, the current environment implies a final import tariff of 90% on Brazil exports, which is having an impact on shipments.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.