China using Russia to get at the US as trade tensions rise

US futures are trading relatively unchanged ahead of the open on Wednesday, taking the lead from Europe where markets have been quite calm early in the day.

It’s been an uneventful day in financial markets so far, with only low level data being released and no major political stories causing a stir. This is likely to just be a temporary lull as tempers continue to flare between the US and China, with the latter using its relationship with Russia to send a message that there’s more than one way to win a trade war.

With China involving the WTO in the dispute and the US preparing more tariffs – and threatening an eventual tariff on all imports – it doesn’t appear this threat is going away any time soon and is something we should just get used to. This could work to the advantage of the EU with Trump engaging in negotiations in an attempt to forge closer trade ties, remove barriers and eliminate the apparent need for new tariffs.

Asia risk continues to wobble (OANDA Trading Podcast 938Now)

Threat of leadership challenge weighing on sterling

The constant flow of Brexit speculation and reports are continuing to find their way into the media, something that is unlikely to change as we get ever closer to the deadline with a deal. Over the last couple of weeks that’s resulted in a lot of volatility for the pound with traders getting very excited at the release of anything that indicates a move away from the no deal scenario.

GBPUSD Daily Chart

OANDA fxTrade Advanced Charting Platform

While I’m sure the pound would have plenty further to fall in the event of a no deal Brexit, a large amount of pessimism has been priced in now which may explain why we see such significant surges in response to relatively insignificant reports. Still, that is the current reality and it’s likely to see the pound remain in its volatile state for some time.

Working against these more optimistic stories has been reports of a leadership challenge with some of the more vocal Brexiteers in Theresa May’s own apparently plodding against her, dissatisfied with the direction negotiations are headed in. The threat of this has prevented the pound making further gains in recent days as its seen as increasing the chances of no deal Brexit or at least a harder one.

EUR/USD – Euro slightly lower as eurozone industrial production misses mark

BoE tomorrow likely to be uneventful

With the Bank of England decision to come tomorrow, the pound is not likely to be steady for long. The central bank isn’t expected to announce any changes tomorrow and will probably prefer to drift into the background as much as possible for the remainder of the year until a deal is reached but that won’t stop traders picking apart the minutes and looking for clues on the timing of the next rate hike.

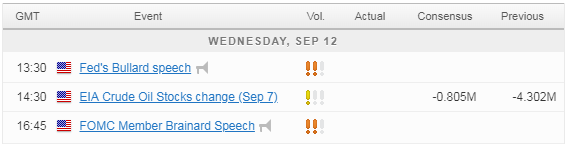

Economic Calendar

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.