Thursday September 13: Five things the markets are talking about

U.S. equity futures and euro regional bourses trade steady after the overnight Asian session put an end to its longest losing streak since 2002 on fresh hopes that the worlds’ two largest economies will again sit down and talk trade.

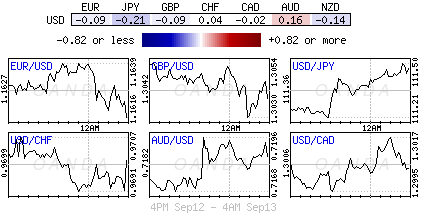

The EUR (€1.1617) and the pound (£1.3040) are little changed ahead of their respective central banks key policy decisions in a few hours.

In anticipation of the European Central Bank’s (ECB) rate announcement (07:45 am EDT) – no rate change is expected – however, investors will be searching for clues about the ECB’s ‘reinvestment policy.’ The bank is expected to downgrade its 2018 eurozone GDP. The reason is likely to be a slowdown in global trade amid trade war uncertainty, rather than a eurozone-specific factor. Eurozone inflation projections are expected to remain unchanged.

Sterling bulls are looking for the pound and short-term interest rates to gain from this morning’s Bank of England (BoE) rate call (07:00 am EDT). Touted support will come from the recent flurry of stronger U.K GDP growth and wage data.

Brexit comments are not expected to have an effect on the pound , as Governor Carney is likely to reiterate that he “assumes a smooth and orderly exit from the E.U.” Also, Carney will want to avoid becoming politicized at such a vital occasion in U.K politics.

For volatility, the market will be looking closely at this morning’s Central Bank of the Republic of Turkey (CBRT) rate announcement. The CBRT needs to raise rates to slow inflation and reverse some of the recent sharp falls in TRY ($6.5345), but faces political pressure from President Erdogan not to. He would cut high interest rates, as he believes high inflation is a result of CBRT’s wrong steps. TRY is expected to weaken further without a sufficient rate increase. The market is pricing anything from zero to +725 bps hike.

Elsewhere, crude oil prices have retreated a tad, mostly on the outlook for tighter supply. Also, the potential impact on commodities from Hurricane Florence has eased along with lower wind speeds.

On tap: Both China and the U.S will release its I.P numbers and retail sales data Friday.

1. Stocks see the light

Global stocks have pared some of this month’s loss overnight; climbing on the news that the U.S had invited China to a new round of trade talks.

In Japan, the Nikkei rallied to two-week highs overnight as news of a proposed fresh round of trade talks between China and the U.S lifted risk appetite. The Nikkei share average soared +1.0%, while the broader Topix surged +1.1%.

Down-under, Aussie stocks were the outlier, falling Thursday as banks and insurers were sold on the back of damaging testimony at a public inquiry, though gains in miners on a recovery in commodity prices capped the losses. The S&P/ASX 200 index fell -0.8%. In S. Korea, the Kospi stock index rallied +0.18% following Sino-U.S trade talk news.

In Hong Kong, Chinese banks helped push the Hang Seng index +2.5% higher, while in China, the Shanghai Composite Index was up +1.2%, although that index still remained down almost -19% on the year after the release of subdued credit growth and new loans figures out of China.

In Europe, regional bourses trade mixed as investors focus on upcoming macro events with rate decisions by ECB and BoE on tap.

U.S stocks are set to open in the ‘black’ (+0.1%).

Indices: Stoxx50 +0.4% at 3,341, FTSE -0.2% at 7,299, DAX +0.5% at 12,090, CAC-40 +0.4% at 5,351; IBEX-35 +0.3% at 9,322, FTSE MIB -0.2% at 20,930, SMI +0.2% at 8,974, S&P 500 Futures +0.1%

2. Oil slips as economic concerns counter tighter supply, gold steady

Oil prices are under pressure, falling from their four-month highs as investors focused on the risk that EM crises and trade disputes could dent demand.

Benchmark Brent crude oil is down -70c a barrel at +$79.04, while U.S light crude (WTI) fell -$1.15 to a low of +$69.22 a barrel.

The IEA indicated this morning that although the oil market was tightening at the moment and world oil demand would soon reach +100M bpd, global economic risks were mounting.

Note: Brent rallied above +$80 per barrel yesterday for the first time since May, supported by expectations that U.S sanctions against Iran’s oil exports, which will start in November, will tighten global markets. U.S light crude pushed over +$70 on Wednesday due to falling U.S crude inventories and production levels.

Ahead of the U.S open, gold prices trade steady, atop of their one-week high, amid hopes for a new round of Sino-U.S trade talks. However, a firmer U.S dollar is expected to keep gains in check. Spot gold is at +$1,205.78 an ounce, after hitting its highest since Aug. 31 at +$1,208.48.

Note: The ‘yellow’ metal gained +0.7% in yesterday’s session, its biggest single-day rise since Aug. 24.

3. Yields steady ahead of ECB and BoE

Both the ECB and BoE are not expected to make any major policy changes this morning.

The demand for safe-haven government debt has also been weak this month by declining fears about the political situation in Italy, where a new populist government is working on its first budget proposal. They expect to adhere to the E.U rules and regulations.

This week’s selling of high-grade sovereign bonds has been led by Europe, with the 10-year German Bund yield backing up to +0.431% from Wednesday’s +0.404%. In the U.K, the 10-year Gilt yield increased to +1.498% from +1.470%.

Stateside, U.S government bond prices are also lower as the market braces for the possibility of tighter monetary policy – a further two rate hikes are been priced in by Fed by the end of 2018. U.S 10’s are trading just shy of the psychological +3% level at +2.97%.

4. A sufficient CBRT hike could weaken the dollar vs. EM FX

If the CBRT were to aggressively hike interest rates this morning, this would likely dampen investors’ appetite for the U.S dollar against EM currency pairs. It may also help the EUR (€1.1616), given that European banks are lenders to Turkish businesses.

However, most EUR moves will be driven by the CB rhetoric. The ECB’s Draghi will likely sound “dovish” by lowering growth forecasts for 2018, which should prevent the ‘single’ currency from gaining on any other factors.

It too would not be a surprise if the CBRT were to disappoint, especially after President Erdogan reiterated this morning his view that interest rates should be cut. USD/TRY is last up +3% at $6.5433. EUR/USD is down -0.1% at €1.1619.

Note: If the Fed continues to raise interest rates, the currencies of Turkey, South Africa, Malaysia, India and Indonesia would be hardest hit. The less vulnerable currencies would be those of South Korea, China, Thailand and Russia.

5. Aussie employment

Overnight, Australia added a stellar +44K jobs in August, the second-highest monthly add in the last nine-months. Even more impressive was the fact that nearly all of the jobs, +33.7K, were in the full-time category and despite a higher participation rate, 65.7% from 65.5%; the unemployment rate remained steady at 5.3%.

This strong report will be much welcomed by the Reserve Bank of Australia (RBA) – more workers mean more tax revenue, and possibly a long-awaited uptick in wage growth as household budgets are strained.

It does not signal an imminent interest-rate increases, but ‘hawkish’ rhetoric could enter the fray.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.