Thursday September 20: Five things the markets are talking about

It’s not been easy, two and two do not add up when trading these Twitter directional asset classes. Fundamentals have been temporary ignored as the ‘lemming’ trades takes a grip.

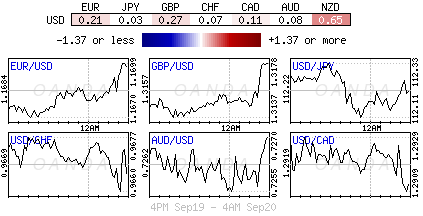

Fading market fears over a Sino-U.S trade row has the U.S dollar trading within striking distance of its two-month lows. Even emerging-market currency pairs have found some traction after China said it would not retaliate with competitive currency devaluations.

Global equities are beginning to struggle as U.S yields approach their highest level this year.

In Europe, U.K Consumer spending remains buoyant despite Brexit uncertainties. Norway raises interest rates for the first time in seven-years and the Swiss kept rates on hold.

1. Stocks mixed results

In Japan, the Nikkei ended little changed overnight as an extended rally in financial sector was largely offset by profit taking after this weeks rally. The Nikkei inched up +0.01%, just about staying in positive territory for the fifth consecutive session. The broader Topix added +0.11%.

Down-under, Aussie shares slipped overnight, led lower by banks and consumer staples as investors shifted funds to emerging markets as they became less worried about a U.S-China trade war. The S&P/ASX 200 index fell -0.3% at the close of trade. The benchmark gained +0.5% yesterday. In S. Korea, the Kospi index rallied +0.65%, supported again mostly by Samsung.

Stocks in China fell overnight, as investor sentiment remained fragile following the latest hit of tariffs in the Sino-U.S. trade war. At the close, the Shanghai Composite index and the blue-chip CSI300 index were both down -0.1%.

In Hong Kong, there were mixed results as some investors held on to hopes that China and the U.S would eventually reach an agreement to avert an all-out trade war. The Hang Seng Index rose +0.26%, while the Shanghai Composite Index slipped -0.06%.

In Europe, regional bourses have opened broadly higher. Market will focus on the ‘informal’ E.U leaders summit comments.

U.S stocks are set to open little changed (+0.0%).

Indices: Stoxx50 +0.3% at 3,379, FTSE +0.1% at 7,334, DAX +0.2% at 12,248, CAC-40 +0.4% at 5,415, IBEX-35 +0.4% at 9,526, FTSE MIB +0.5% at 21,396, SMI +0.4% at 8,974, S&P 500 Futures flat

2. Oil steady, supported by U.S. stocks and supply concerns

Oil prices trade steady, nevertheless, the market remains a tad better ‘bullish’ after this week’s U.S crude inventory reports and on signs that OPEC may not raise production enough to compensate for the loss of Iranian exports hit by U.S. sanctions.

Brent crude oil is unchanged at +$79.40 a barrel, while U.S light crude oil is +40c higher at +$71.52 after rising nearly +2% in yesterday’s session.

Note: Brent has been trading below $80 for the past week after conflicting reports of the market views of Saudi Arabia, the biggest producer in OPEC. They wanted oil to stay between +$70 and +$80 a barrel for now, seeking a balance between maximizing revenue and keeping a lid on prices until U.S midterms. However, giving the market a bid undertone are reports yesterday indicating that the Saudi’s were happy with prices above +$80 a barrel.

EIA data Wednesday showed that U.S crude oil stockpiles fell for a fifth consecutive week to a three-year low in the week to Sept. 14, while gas stocks also showed a larger than expected draw on unseasonably strong demand. Crude inventories fell by -2.1m barrels, compared with expectations for a decrease of -2.7m.

Note: OPEC and other producers, including Russia, meet on Sunday in Algeria to discuss how to allocate supply increases to offset the loss of Iranian barrels.

Ahead of the U.S open, gold prices have inched higher as the ‘big’ dollar softened amid easing Sino-U.S trade tensions. Nevertheless, expect investors to remain cautious ahead of next week’s Fed meeting. Spot gold is up +0.1% at +$1,204.69, after rising +0.5%yesterday.

3. Norway hikes rates for the first time in seven years, SNB on hold

Earlier this morning, Norway’s central bank hiked its key interest rate for the first time in more than seven-years. Norges Bank increased the rate to +0.75% from +0.5%.

The central bank said another rate increase is likely in the first three months of next year, with a gradual series of moves taking it to +2% by the end of 2021.

“If the key policy rate is kept at the current level for too long, price and wage inflation may accelerate and financial imbalances build up further,” said Governor Olsen. “That would increase the risk of a sharp economic downturn further out.”

Note: Sweden has also indicated that it may raise its key rate before the end of the year, while the ECB plans to end QE in December.

Elsewhere, the Swiss National Bank (SNB) kept its deposit rate at -0.75%, as expected. The accompanying statement painted two different pictures – the negative rate and willingness to intervene in FX markets “remain essential in order to keep the attractiveness of CHF low and thus ease pressure on the currency.” That said, policy makers also painted a brighter economic future and raised its 2018 GDP forecast to between +2.5% and +3%.

4. Dollar downfall

The CHF ($0.9659) is a tad weaker after the Swiss National Bank (SNB) left rates on hold. The fact that the franc remains “highly valued and has appreciated noticeably” has investors wary of the bank’s next moves.

EUR/NOK (€9.6068) initially fell following the Norges rate hike, but has since reversed and is trading down -1% outright after the bank cut its policy rate forecasts.

GBP/USD (£1.3226) has rallied sharply, again testing yesterday’s intraday highs, on Brexit talk and on stronger than expected U.K retail sales (see below).

USD/ZAR is down by -1.5% at $14.4793 – some investors are anticipating a surprised rate hike this morning. Nevertheless, the consensus expects rates to remain unchanged, given that prices remain within the bank’s inflation target range and that the economy has slid into a recession.

5. U.K retail sales slowed in August

Data this morning showed that U.K. retail sales slowed in August but continued to point to buoyant consumer spending in Q3, which suggests that the economy has kept expanding despite uncertainty over Brexit.

According to the ONS, U.K retail sales rose +0.3% on month in August, after a revised +0.9% rise in July.

Digging deeper, consumer spending continues to power the U.K economy as sales increased across most store categories with the exception of food and clothing outlets.

But is it sustainable, given high inflation, low wage growth and rising interest rates? Uncertainty over the U.K’s future continues to deter investment.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.